Value Added Tax (VAT) is a tax that affects all consumers and, a priori, you must pay it every time you buy a product or service. However, there is a number of activities exempt from VAT.

These cases are referred to in Law 37/1992, of 28 December, on Value Added Tax. Do you want to know if the professional activity you do is free of this tribute? Today we answer you in this article.

Activities exempt from VAT and non-subject activities

Confusion is common between exemption from the tax and non-taxation.

In the case of VAT, the final conclusion is the same: the tax should not be paid.

But the reasons for this non-obligation to pay are different.

Non-subject activities

They are those in which there is no tax obligation. The most common example is the delivery of free samples and the provision of free demonstration services, with promotional overtones.

Activities exempt from VAT

In these cases there is a tax obligation but, by legal provision, it is established that the sale of certain products or services to which the tax is not applied.

This exemption in the payment of VAT can be total or partial, that is, depending on whether it exempts from total VAT or only on a part:

- The full exemption occurs when the company or the self-employed person offering a certain product or service does not have to declare either the input VAT or the output VAT. You don’t pay VAT but you don’t charge it either.

- In cases of limited exemption, the professional does not pass VAT on the invoices he issues, but he must pay it when buying products or services necessary to carry out his activity.

Activities often involving services necessary to ensure adequate access to fundamental rights,such as health or education, are also exempt.

Activities exempt from VAT

EDUCATION

Educational activities carried out in public or private schools, as well as face-to-face private lessons on subjects that are part of official curricula.

Nor the services of attention to children that are carried out in educational centers in interlective time.

SOCIAL, CULTURE AND SPORT

Social, cultural and sports activities should not pay VAT, providedthat the entity is not for profit and its legal representative does not charge for performing his position.

Within the cultural field, creative professionals (writers, screenwriters, etc.) are exempt from paying VAT.

However, editors, journalists and community managers must declare VAT.

BLESS YOU

Medical and health activities in public or private health if they are under the authorized price regime.

It does not include the operations of cosmetic surgery, acupuncture, mesotherapy, naturotherapy and veterinary services,in which the tax must be declared.

FINANCE AND INSURANCE

Financial and insurance-related activities. All operations related to insurance contracting and financial activities, such as granting loans or selling credit cards,are exempt from VAT.

Mediation services for natural persons in financial transactions are also exempt.

SEALS

Stamped effects of legal tender and postage stamps are also not taxed by this tax.

PROPERTIES

In the case of rental of housing and delivery of rustic land not buildable,as well as in the second and subsequent deliveries of buildings; the exemption from this tax also applies.

FOREIGN TRADE

There are also a number of activities related to foreign trade in which VAT is not applicable either.

These are the supply or transport of goods from the peninsular territory and the islands to other Member States of the European Union or to third territories.

Exemption from VAT is also given in export operations carried out by partners participating in the company, in their name and on their own account.

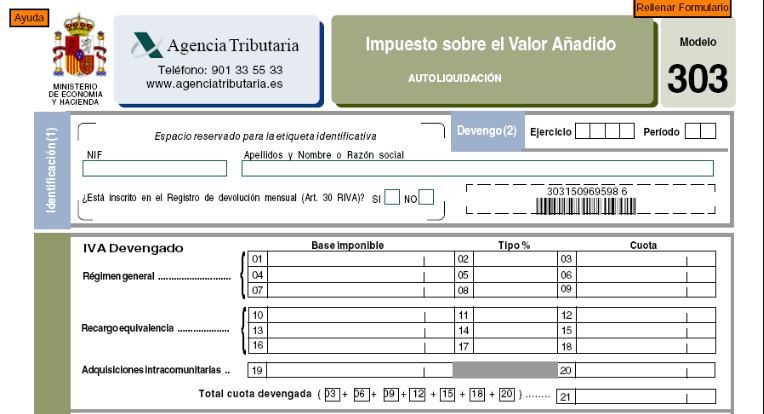

Form 303 in activities exempt from VAT

Form

303

must be submitted every quarter to the Tax Administration, in order to declare the VAT passed on as a professional during that time.

If you develop an activity that involves applying Value Added Tax and another that does not, in the form you must indicate only the VAT corresponding to the activity that is not exempt.

If you are a professional who only carries out activities exempt from tax, it is advisable to check “yes” in the box of form 036 in which it is asked if the activity is totally exempt from VAT.

In these cases it will no longer be necessary to present the form 303 every quarter, you will only have to present the 130,which is the one that corresponds to the Personal Income Tax return.

Invoicing in cases of VAT exemption

Often, many customers are surprised to see an invoice that does not include VAT being issued.

To avoid problems or that someone may think that there is a defrauding spirit, it is best to include in the invoice itself a clarification indicating that the activity is exempt from tax under the provisions of article 20 of the VAT Law.

In order not to have problems with the Tax Agency, it is important to bear in mind that, even if you carry out activities exempt from VAT, the corresponding income tax withholding must be applied if it is an invoice issued to a self-employed person or a company.

In addition, as a professional, you must be registered with the Treasury and have filed a census declaration of the Economic Activities Tax (IAE).