Since January 1, 2019, the protective action of the RETA is extended, establishing the mandatory nature of the protection for cessation of activity and for professional contingencies. The modification implies changes in the benefits for these contingencies, as well as in the contribution rules; and also establishes the minimum bases and contribution rates applicable in this special regime during 2019, as well as modifications in the flat rate of contribution.

Changes for the self-employed

Royal Decree Law 28/2018 introduces important modifications to the RETA. These amendments entered into force on January 1, 2019, affecting the following matters:

I. Extension of reta’s protective action

Law 20/2007 (LETA) and the General Law on Social Security are amended to extend the protective action of the RETA, incorporating mandatory protection for cessation of activity and for professional contingencies, which until now were voluntary.

The coverage of occupational contingencies, temporary disability and cessation of activity must be formalized, with the same mutual society collaborating with the Social Security (MCSS). However, a special time limit is set for workers who had joined the RETA before January 1, 1998 and who had chosen to maintain temporary disability protection with the managing body, who must opt for an MCSS before April 1, 2019, taking effect from June 1, 2019. Until then, the cessation of activity benefit will continue to be managed by the Public State Employment Service (SPEE) and professional contingencies will be covered by the INSS.

The compulsory coverage of occupational contingencies, as well as that corresponding to Temporary Disability or that of the benefit for cessation of activity does not reach the members of cooperatives included in the RETA that have an intercooperative system of social benefits, complementary to the public system, that has the authorization of the Social Security to collaborate in the management of the economic benefit of Temporary Disability and grants protection for the aforementioned contingencies, with a scope at least equivalent to that regulated by the RETA.

In addition, the following modifications should be taken into account:

(a) In the case ofoccupational contingencies:

- The concepts of accident at work and occupational disease of self-employed workers, until now included in the General Law on Social Security art.316.2, are incorporated into article 26 of the LETA.

- It is expected that from the year 2022,the applicable contribution rate will be established, definitively, in the corresponding Law of General State Budgets. Until then, the applicable rate will be as follows: 0.9 in 2019; 1.1% in 2020 and 1.3% in 2021.

- As a result of the mandatory inclusion of professional contingencies in the scope of application of the RETA, the birth of the economic benefit of Temporary Disability derived from these contingencies will occur from the day following the reduction. In case it derives from common contingencies, the benefit arises from the 4th day of the leave.

(b) With regard to cessation of activity:

- Article 327 of the General Social Security Act is amended to establish the mandatory nature of their protection.

- The birth of the economic benefit, whose payment corresponds to the MCSS with which the contingency has been covered, occurs at the following times:

- up to 3 casualties within each calendar year: from the day following the cessation of activity.

- the rest of the casualties within each calendar year: the first day of the month following the low due to cessation of activity.

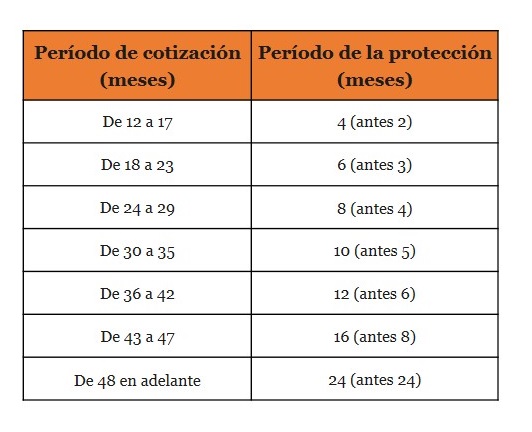

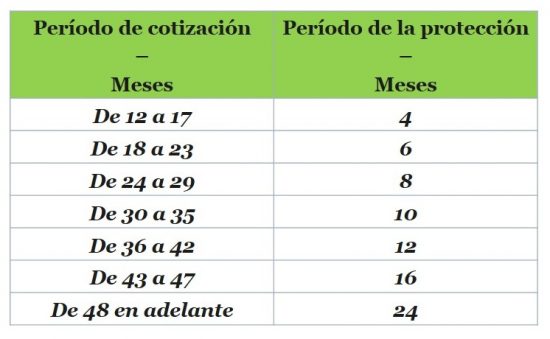

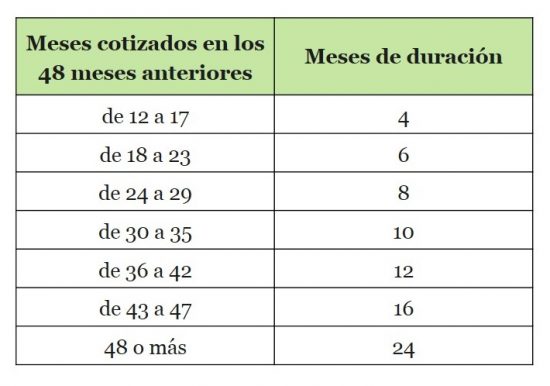

- The intensity of the protection for cessation of activity is improved by doubling its duration in the following terms:

- The legal provision according to which the suspension of the benefit occurs for full monthly payments. The same duration is to apply to self-employed workers aged between 60 and the ordinary retirement age, for whom a different duration of benefit has hitherto been established.

- The contribution rate applicable to the coverage of the cessation of activity protection shall be fixed annually without being higher than 4% or less than 0.7%. This reduces the minimum rate which has hitherto been set at 2.2%. It is expected that from the year 2022,the applicable contribution rate will be established, definitively, in the corresponding Law of General State Budgets. Until then, the applicable rate will be as follows: 0.7 in 2019; 0.8% in 2020 and 0.9% in 2021.

- Finally, it is envisaged as a novelty, the constitution of a joint committee in which the mutual societies, the representative associations of the self-employed and the Social Security Administration are represented, which will act in the event that they present themselves. previous claims against the resolutions of the mutual society in terms of recognition, suspension or extinction of the benefit for cessation of activity. In these cases, the mutual society must send the committee the reasoned proposal for the resolution of the previous complaint so that it can issue its binding report.

Ⅱ. quote

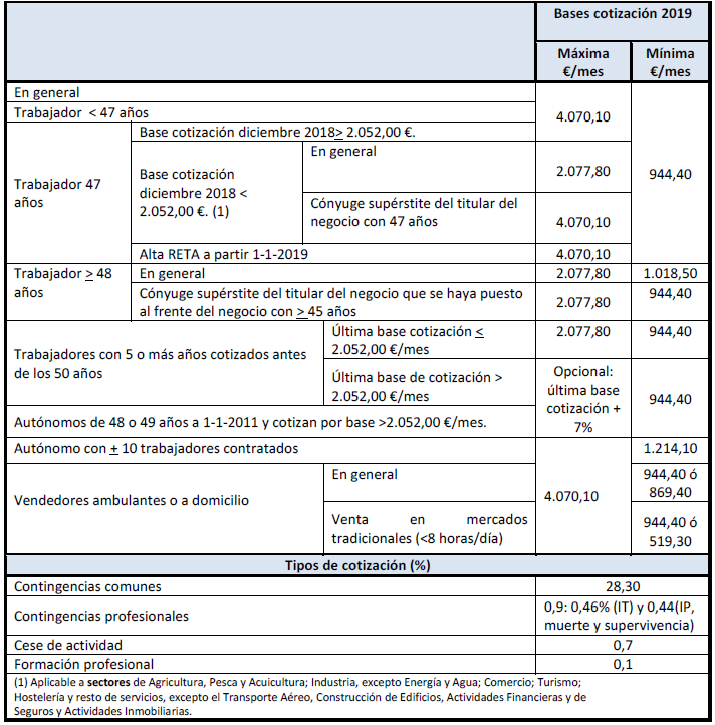

a) The minimum bases and contribution rates applicable in the RETA are established for 2019.

The minimum bases are increased by 1.25%, being set in general at 944.40 euros per month.

The contribution rates applicable during 2019 are as follows:

- common contingencies: 28.30%;

- occupational contingencies: 0.9% (0.46 per TD and 0.44 per permanent disability, death and survival);

- cessation of activity: 0.7%;

- vocational training: 0.1%.

b) The benefitsto the quote in the RETA are modified:

- The amount of the flat rate, which includes both the contribution for common contingencies (€51.50) and for professional contingencies (€8.50), is raised from €50 to €60 per month. Workers benefiting from this contribution benefit are exempt from the obligation to contribute for cessation of activity and vocational training (LETA art.31).

- the flat rate is extended to those who, being registered in the RETA, have a disability to a degree equal to or greater than 33%.

- the bonus for workers who return to work after having ceased their activity due to maternity, adoption, custody for the purposes of adoption, foster care and guardianship will be applied when the reinstatement occurs within 2 years immediately following the effective date of the cessation (previously it was when the reinstatement occurred in the following 2 years).

- the flat rate established for the RETA is extended to the special system of self-employed agricultural workers, as well as the contribution benefits for people with disabilities and victims of gender violence and victims of terrorism (LETA art.32 bis).

(c) In the situation of Temporary Disabilitywith the right to economic benefit,after 60 days in a situation of medical leave, the payment of the fees for all contingencies corresponds to the MCSS, to the managing entity or, where appropriate, to the SPEE, with charge to the quotas for cessation of activity. When the payment is assumed by the SPEE, the amount to be paid will be fixed by means of a coefficient applicable to the total contributions for cessation of activity of all workers covered by that entity and that will be fixed annually in the Contribution Order.

d) Article 311 of the General Social Security Law is amended to clarify the terms of the refund of contributions in case of contributions under a pluriactivityregime. The refund will consist of 50% of the excess in which the contributions for common contingencies exceed the amount established in the General State Budget Law and that for 2019 is set, by Royal Decree Law 28/2018, at 13,822.06 euros per year. The amount of the refund may not exceed 50% of the fees paid into the RETA for common contingencies.

Iii. Other issues

Along with the changes introduced in the scope of protection of the RETA and in the quotation, other important modifications are included:

(a) Article 22 of the Law on Offences and Sanctions in the Social Order (LISOS) is amended to include the serious infringementconsisting of communicating the withdrawal from a Social Security scheme of employed workers despite continuing the same work activity or maintaining the same provision of services, using an undue registration in a scheme for self-employed workers. This conduct is punishable by a fine of between 3,126 and 10,000 euros.

(b) A procedure is created to enable the General Treasury of the Social Security (TGSS) to verify the continuity of the activityof self-employed workers who have stopped paying contributions. The proceedings will begin with the commencement of enforcement proceedings once the enforcement order has been issued. If the cessation of activity is accredited, the TGSS cancels the self-employed worker from the RETA.

(c) The establishment of a part-time contributionsystem for self-employed workers is again postponed indefinitely.

Flat rate: legislative amendments (LETA)

Until December 31, 2018: Article 31. Reductions and bonuses in social security contributions applicable to self-employed persons

1. Self-employed or self-employed workers who cause initial registration or who had not been in a situation of registration in the 2 years immediately preceding, counting from the date of effect of registration, in the Special Social Security Scheme for Self-Employed or Self-Employed Workers, will be entitled to a reduction in the contribution for common contingencies, including temporary disability, which will be fixed at the amount of 50 euros per month during the 12 months immediately following the date of effect of the registration, in the event that they choose to contribute for the minimum base that corresponds to them.

Alternatively, those self-employed or self-employed who, fulfilling the requirements laid down in the

previous paragraph,

opt for a contribution base higher than the minimum that corresponds to them, may be applied during the first 12 months immediately following the date of effect of registration, a reduction of 80%

on the quota for common contingencies,

being the quota to be reduced the resulting from applying to the minimum contribution base that corresponds to the minimum contribution rate in force at all times, including temporary disability.

After the initial period of 12 months provided for in the two paragraphs above, and regardless of the contribution base chosen, self-employed workers who benefit from the measure provided for in this article may apply the following reductions and bonuses on the contribution for common contingencies, being the quota to be reduced or subsidized the one resulting from applying to the minimum contribution base that corresponds to the minimum contribution base that corresponds to the minimum contribution rate in force at all times , including temporary disability, for a maximum period of up to 12 months, until completing a maximum period of 24 months after the date of effect of discharge, according to the following scale:

- a) A reduction equivalent to 50% of the quota during the 6 months following the initial period provided for in the first two paragraphs of this paragraph.

- (b) A reduction equivalent to 30 per cent of the quota during the 3 months following the period referred to in the letter (a).

- c) A bonus equivalent to 30% of the quota during the 3 months following the period indicated in the letter (b).

In the event that the self-employed or self-employed worker resides and develops his activity in a municipality in whose updated municipal register at the beginning of the activity there are less than 5,000 inhabitants, after the initial period of 12 months of application

of reductions in the contributions for common contingencies, including temporary disability, established in the first two paragraphs of this section,

shall be entitled during the 12 months following these same incentives. In these cases, the reductions and bonuses for the 12 months following the initial period referred to in the preceding letters shall not apply.

In order to benefit from

these reductions

during the 12 months following the initial period, the self-employed or self-employed worker must:

- Be registered in a municipality of less than 5,000 inhabitants, according to the official data of the register in force at the time of registration in the Special Social Security Scheme for Self-Employed or Self-Employed Workers that causes the right to the incentive contemplated in this article.

- Be registered in the Census of Taxpayers of the State Agency of Tax Administration or the Foral Haciendas, corresponding the place of development of the declared activity to a municipality whose municipal register is less than 5,000 inhabitants.

- Maintain registration in the self-employed or self-employed activity in the aforementioned municipality in the two years following registration in the Special Social Security Scheme for Self-Employed or Self-Employed Workers that causes the right to the incentive contemplated in this article; as well as remain registered in the same municipality in the four years following said discharge.

The General Treasury of the Social Security will carry out the control of this reduction for which the National Institute of Statistics and the aforementioned Tax Administrations must make available to this Common Service the necessary means and information to verify compliance with the requirements required to benefit from this reduction.

In case of not fulfilling these requirements, the self-employed or self-employed worker must refund all the amounts left to pay by the application of the incentive, from the first day of the following month in which such non-compliance is accredited.

2. In the event that the self-employed workers are under 30 years of age, or under 35 years of age in the case of women, and cause initial registration or have not been in a situation of affiliation in the 2 years immediately preceding, counting from the date of effect of registration, in the Special Social Security Scheme for Self-Employed or Self-Employed Workers , may be applied, in addition to the

reductions and bonuses provided for in the previous section,

an additional bonus equivalent to 30%, on the quota for common contingencies, in the 12 months following the end of the period of

bonus provided for in paragraph 1,

the bonus being the one resulting from applying to the minimum contribution base corresponding to the minimum contribution rate in force at all times, including temporary disability. In this case the maximum duration of the reductions and bonuses it will be 36 months.

3. The period of withdrawal from the Special Social Security Scheme for Self-Employed or Self-Employed Workers, required in the previous sections to be entitled to the benefits in the contribution in them provided for in case of resuming a self-employed activity, will be 3 years when the self-employed workers had enjoyed said benefits in their previous period of registration in the aforementioned special regime.

4. In the event that the date of effect of the registrations referred to in paragraphs 1 and 2 does not coincide with the first day of the respective calendar month, the benefit corresponding to that month will be applied in proportion to the number of days of registration in it.

5. The provisions of the preceding paragraphs shall also apply, when they meet the requirements laid down therein, to self-employed workers who are included in the first contribution group of the Special Social Security Scheme for Sea Workers and to members of labour companies and to worker members of associated work cooperatives that are included in the Special Scheme for Workers’ Social Security. for Self-Employed or Self-Employed or in the Special Social Security Scheme for Sea Workers, within the first group of contributions.

6. The provisions of this Article shall apply even if the beneficiaries of this measure, once they have started their activity, employ employed persons.

7. The contribution bonuses provided for in this article shall be financed from the corresponding budget line of the State Public Employment Service and the reductions in contributions shall be borne by the social security revenue budget, respectively.

8. The benefits in the contributions provided for in this article will consist of a bonus in the case of self-employed or self-employed workers registered in the National Youth Guarantee System who meet the requirements established in article 105 of Law 18/2014, of 15 October, on the approval of urgent measures for growth, competitiveness and efficiency, applying this bonus in the same terms as the incentives provided for in paragraph 1 and also being entitled to the additional bonus referred to in paragraph 2.

New precept: Article 32. Reductions and bonuses of social security contributions for people with disabilities, victims of gender-based violence and victims of terrorism who establish themselves as self-employed

1. The contribution for common contingencies, including temporary disability, of persons with a degree of disability equal to or greater than 33%, victims of gender violence and victims of terrorism, who cause initial registration or who had not been in a situation of registration in the 2 years immediately preceding, counting from the date of effect of registration, in the Special Social Security Scheme for Self-Employed or Self-Employed Workers herself reduce to the amount of 50 euros per month during the 12 months immediately following the date of effect of theregistration, in the event that they choose to contribute for the minimum base that corresponds to them.

Alternatively, those self-employed or self-employed who, fulfilling the requirements laid down in the

previous paragraph,

opt for a contribution base higher than the minimum that corresponds to them, may be applied during the first 12 months immediately following the date of effects of the registration, a reduction on the quota for common contingencies, being the quota to be reduced 80%

the result

of applying to the minimum contribution base corresponding to the minimum contribution rate in force at any given time, including temporary incapacity.

After the initial period of 12 months provided for in the two preceding paragraphs, and regardless of the contribution base chosen, self-employed workers who benefit from the measure provided for in this article may apply a bonus on the contribution for common contingencies, the contribution to be subsidized being 50 per cent of the result of applying to the minimum contribution base that corresponds to the minimum contribution rate in force in force in each time, including temporary disability, for a maximum period of up to 48 months, until completing a maximum period of 5 years from the date of effect of discharge.

In the event that the self-employed or self-employed worker resides and develops his activity in a municipality in whose updated municipal register at the beginning of the activity there are less than 5,000 inhabitants, after the initial period of 12 months of application

of reductions in the contributions for common contingencies, including temporary disability, established in the first two paragraphs of this section,

shall be entitled during the 12 months following these same incentives. In these cases the application of the bonus for 50%, provided for in the previous paragraph, will be applied, once the initial 24 months have elapsed, for a maximum period of up to 36 months, until completing a maximum period of 5 years from the date of effect of registration.

In order to benefit from

these reductions

during the 12 months following the initial period, the self-employed or self-employed worker must:

- Be registered in a municipality of less than 5,000 inhabitants, according to the official data of the register in force at the time of registration in the Special Social Security Scheme for Self-Employed or Self-Employed Workers that causes the right to the incentive contemplated in this article.

- Be registered in the Census of Taxpayers of the State Agency of Tax Administration or the Foral Haciendas, corresponding the place of development of the declared activity to a municipality whose municipal register is less than 5,000 inhabitants.

- Maintain registration in the self-employed or self-employed activity in the aforementioned municipality in the two years following registration in the Special Social Security Scheme for Self-Employed or Self-Employed Workers that causes the right to the incentive contemplated in this article; as well as remain registered in the same municipality in the four years following said discharge.

The General Treasury of the Social Security will carry out the control of this reduction for which the National Institute of Statistics and the aforementioned Tax Administrations must make available to this Common Service the necessary means and information to verify compliance with the requirements required to benefit from this reduction.

In case of not fulfilling these requirements, the self-employed or self-employed worker must refund all the amounts left to pay by the application of the incentive, from the first day of the following month in which such non-compliance is accredited.

2. The period of leave in the Special Social Security Scheme for Self-Employed or Self-Employed Workers, required in the

previous section

to be entitled to the benefits in the contribution in it provided in case of resuming an activity on a self-employed basis, it will be 3 years when the self-employed workers had enjoyed said benefits in their previous period of registration in the aforementioned special regime.

3. In the event that the date of effect of the registrations referred to in

paragraph 1

does not coincide with the first day of the respective calendar month, the benefit corresponding to that month shall be applied in proportion to the number of days of registration in it.

4. The provisions of the preceding paragraphs shall also apply, when they meet the requirements laid down therein, to self-employed workers who are included in the first contribution group of the Special Social Security Scheme for Sea Workers and to members of labour companies and to worker members of associated work cooperatives that are included in the Special Scheme for Workers’ Social Security. for Self-Employed or Self-Employed or in the Special Social Security Scheme for Sea Workers, within the first group of contributions.

5. The provisions of this Article shall apply even if the beneficiaries of this measure, once they have started their activity, employ employed persons.

6. The contribution bonuses provided for in this Article shall be financed from the corresponding budget line of the State Public Employment Service and the reductions in contributions shall be borne by the social security revenue budget, respectively.

New provision : Article 38 bis. Bonuses for self-employed women who return to work in certain cases

Workers included in the Special Social Security Scheme for Self-Employed Or Self-Employed Workers or as self-employed workers in the first contribution group of the Special Social Security Scheme for Sea Workers, who, having ceased their activity due to maternity, adoption, keep for the purpose of adoption , foster care and guardianship, in the legally established terms, return to carry out an activity on their own account within two years of the date of cessation, they will be entitled to a bonus under which their share for

Common contingencies,

including temporary incapacity, shall be fixed at the amount of

50 euros per month

for

the 12 months

immediately following the date of their return to work, provided that they choose to contribute to the minimum base established in general in the special scheme that corresponds to the self-employed activity.

Those self-employed or self-employed workers who, fulfilling the above requirements, opt for a contribution base higher than the minimum indicated in the previous paragraph, may apply during the aforementioned period a bonus of 80 per cent on the quota for common contingencies, being

the bonus fee

resulting from applying to the minimum contribution base

established

in general under the relevant special regime the minimum contribution rate in force at any given time, including temporary incapacity.

As of January 1, 2019: Article 31. Social security contribution benefits applicable to self-employed workers

Social Security contributions of self-employed or self-employed workers who cause initial registration or who had not been in a situation of affiliation in the 2 years immediately preceding, counting from the date of effect of registration, in the Special Social Security Scheme for Self-Employed or Self-Employed Workers, shall be carried out as follows:

1. In the event that it is chosen to contribute for the corresponding minimum base, they may benefit from a reduction in the contribution for common contingencies during the first 12 months immediately following the date of effect of the registration, which it will consist of a single monthly fee of 60 euros, which will include both common contingencies and professional contingencies, leaving these workers exempt from contributions for cessation of activity and professional training. Of this fee of 60 euros, 51.50 euros correspond to common contingencies and 8.50 euros to professional contingencies.

2. Alternatively, those self-employed or self-employed workers who, fulfilling the requirements set out in the previous section, opt for a contribution base higher than the minimum that corresponds, may be applied during the first 12 months immediately following the date of effects of registration, a reduction of 80% on the contribution for common contingencies, being the quota to be reduced the resulting from applying to the minimum contribution base that corresponds the minimum contribution rate in force for common contingencies.

After the initial period of 12 months provided for in the two previous sections, and regardless of the contribution base chosen, self-employed workers who benefit from the measure provided for in this article may apply the following reductions and bonuses on the contribution for common contingencies, being the quota to be reduced or subsidized the one resulting from applying to the minimum contribution base that corresponds to the contribution rate in force in each moment for common contingencies, for a maximum period of up to 12 months, until completing a maximum period of 24 months after the date of effects of the discharge, according to the following scale:

- a) A reduction equivalent to 50% of the quota during the 6 months following the initial period provided for in the first two paragraphs of this paragraph.

- (b) A reduction equivalent to 30 per cent of the quota during the 3 months following the period referred to in the letter (a).

- c) A bonus equivalent to 30% of the quota during the 3 months following the period indicated in the letter (b).

3. In the event that the self-employed or self-employed worker resides and develops his activity in a municipality in whose updated municipal register at the beginning of the activity there are less than 5,000 inhabitants, after the initial period of 12 months of application of the contribution benefits established in the previous sections,you will be entitled during the 12 months following these same incentives. In such cases, the reductions and rebates for the 12 months following the initial period referred to in paragraph 2 shallnot apply.

In order to benefit from these measures during the 12 months following the initial period, the self-employed or self-employed worker must:

- Be registered in a municipality of less than 5,000 inhabitants, according to the official data of the register in force at the time of registration in the Special Social Security Scheme for Self-Employed or Self-Employed Workers that causes the right to the incentive contemplated in this article.

- Be registered in the Census of Taxpayers of the State Agency of Tax Administration or the Foral Haciendas, corresponding the place of development of the declared activity to a municipality whose municipal register is less than 5,000 inhabitants.

- Maintain registration in the self-employed or self-employed activity in the aforementioned municipality in the two years following registration in the Special Social Security Scheme for Self-Employed or Self-Employed Workers that causes the right to the incentive contemplated in this article; as well as remain registered in the same municipality in the four years following said discharge.

The General Treasury of the Social Security will carry out the control of this reduction for which the National Institute of Statistics and the aforementioned Tax Administrations must make available to this Common Service the necessary means and information to verify compliance with the requirements required to benefit from this reduction.

In case of not fulfilling these requirements, the self-employed or self-employed worker must refund all the amounts left to pay by the application of the incentive, from the first day of the following month in which such non-compliance is accredited.

4. In the event that the self-employed workers are under 30 years of age, or under 35 years of age in the case of women, and cause initial registration or have not been in a situation of affiliation in the 2 years immediately preceding, counting from the date of effect of registration, in the Special Social Security Scheme for Self-Employed or Self-Employed Workers , may be applied, in addition to the contribution benefits provided for in the previous sections,an additional bonus equivalent to 30%, on the quota for common contingencies, in the 12 months following the end of the maximum period of enjoyment of the same,being the quota to be subsidized the result of applying to the minimum contribution base that corresponds the contribution rate for common contingencies in force at all times. In this case the maximum duration of the enjoyment of the benefits in the contribution will be 36 months.

5. The period of withdrawal from the Special Social Security Scheme for Self-Employed or Self-Employed Workers, required in the previous sections to be entitled to the benefits in the contribution in them provided for in case of resuming a self-employed activity, will be 3 years when the self-employed workers had enjoyed said benefits in their previous period of registration in the aforementioned special regime.

6. In the event that the date of effect of the registrations referred to in paragraphs 1 to 4 does not coincide with the first day of the respective calendar month, the benefit corresponding to that month will be applied in proportion to the number of days of registration in it.

7. The provisions of the preceding paragraphs shall also apply, when they meet the requirements laid down therein, to self-employed workers who are included in the first contribution group of the Special Social Security Scheme for Sea Workers and to members of labour companies and to worker members of associated work cooperatives that are included in the Special Scheme for Workers’ Social Security. for Self-Employed or Self-Employed or in the Special Social Security Scheme for Sea Workers, within the first group of contributions.

8. The provisions of this Article shall apply even if the beneficiaries of this measure, once they have started their activity, employ employed persons.

9. The contribution bonuses provided for in this Article shall be financed from the corresponding budget line of the State Public Employment Service and the reductions in contributions shall be borne by the social security revenue budget and by the mutual societies collaborating with the social security,respectively.

10. The benefits in the contributions provided for in this article will consist of a bonus in the case of self-employed or self-employed workers registered in the National Youth Guarantee System who meet the requirements established in article 105 of Law 18/2014, of 15 October, on the approval of urgent measures for growth, competitiveness and efficiency, applying said bonus in the same terms as the incentives provided for in paragraphs 1 to 3 and also being entitled to the additional bonus referred to in paragraph 4.

11. After the maximum period of enjoyment of the contribution benefits contemplated in this article, the contribution will proceed for all the protected contingencies from the first day of the month following the one that the end occurs.

Article 31 bis. Benefits in social security contributions applicable to self-employed agricultural workers

The social security contributions of self-employed agricultural workers included in the Special System for Self-Employed Agricultural Workers who cause initial registration or who have not been registered in the 2 years immediately preceding, counting from the date of effect of registration in said Special System , shall be carried out as follows:

1. In the event that they choose to contribute for the corresponding minimum base, they may benefit from a reduction in the contribution for common contingencies during the first 12 months immediately following the date of effects of the registration, which will consist of a single monthly fee of 50 euros, corresponding to common contingencies, leaving these workers exempt from contributions for cessation of activity and professional training.

2. Alternatively, those self-employed agricultural workers who, fulfilling the requirements laid down in the previous section, opt for a contribution base higher than the minimum that corresponds, may apply during the first 12 months immediately following the date of effect of the registration, a reduction of 80 per cent on the contribution for common contingencies , being the quota to be reduced the result of applying to the minimum contribution base that corresponds to the minimum contribution rate in force for common contingencies.

After the initial period of 12 months provided for in the two previous sections, and regardless of the contribution base chosen, agricultural self-employed workers who benefit from the measure provided for in this article may apply the following reductions and bonuses on the quota for common contingencies, the contribution to be reduced or subsidized being the one resulting from applying to the minimum contribution base that corresponds to the current contribution rate at all times for common contingencies, for a maximum period of up to 12 months, until completing a maximum period of 24 months after the date of effects of discharge, according to the following scale:

- a) A reduction equivalent to 50% of the quota during the 6 months following the initial period provided for in the first two paragraphs of this paragraph.

- (b) A reduction equivalent to 30 per cent of the quota during the 3 months following the period referred to in the letter (a).

- c) A bonus equivalent to 30% of the quota during the 3 months following the period indicated in the letter (b).

3. In the event that the self-employed agricultural worker resides and develops his activity in a municipality in whose updated municipal register at the beginning of the activity there are less than 5,000 inhabitants, after the initial period of 12 months of application of the benefits in the contribution established in the previous sections, he will be entitled during the 12 months following these same incentives. In such cases, the reductions and bonuses for the 12 months following the initial period referred to in paragraph 2 shall not apply.

In order to benefit from these measures during the 12 months following the initial period, the self-employed agricultural worker must:

- Be registered in a municipality of less than 5,000 inhabitants, according to the official data of the register in force at the time of registration in the Special System for Self-Employed Agricultural Workers that causes the right to the incentive contemplated in this article.

- Be registered in the Census of Taxpayers of the State Agency of Tax Administration or the Foral Haciendas, corresponding the place of development of the declared activity to a municipality whose municipal register is less than 5,000 inhabitants.

- Maintain registration in the autonomous or self-employed activity in the aforementioned municipality in the two years following the registration in the Special System for Self-Employed Agricultural Workers that causes the right to the incentive contemplated in this article; as well as remain registered in the same municipality in the four years following said discharge.

The General Treasury of the Social Security will carry out the control of this reduction for which the National Institute of Statistics and the aforementioned Tax Administrations must make available to this Common Service the necessary means and information to verify compliance with the requirements required to benefit from this reduction.

In case of not fulfilling these requirements, the self-employed agricultural worker must refund all the amounts left to pay by the application of the incentive, from the first day of the following month in which such non-compliance is accredited.

4. In the event that the self-employed agricultural workers are under 30 years of age, or under 35 years of age in the case of women, and cause initial registration or have not been in a situation of registration in the 2 years immediately preceding, counting from the date of effect of registration, in the Special System for Self-Employed Agricultural Workers , may be applied, in addition to the benefits in the contribution provided for in the previous sections, an additional bonus equivalent to 30 percent, on the quota for common contingencies, in the 12 months following the end of the maximum period of enjoyment of the same, being the quota to be subsidized the result of applying to the minimum contribution base that corresponds to the contribution rate for common contingencies in force at all times. In this case the maximum duration of the enjoyment of the benefits in the contribution will be 36 months.

5. The period of withdrawal from the Special System for Self-Employed Agricultural Workers required in the previous sections to be entitled to the benefits in the contribution in them provided for in case of resuming a self-employed activity, will be 3 years when the self-employed workers had enjoyed said benefits in their previous period of registration in the aforementioned special regime.

6. In the event that the date of effect of the registrations referred to in paragraphs 1 to 4 does not coincide with the first day of the respective calendar month, the benefit corresponding to that month will be applied in proportion to the number of days of registration in it.

7. The provisions of this Article shall apply even if the beneficiaries of this measure, once they have started their activity, employ employed persons, within the limits laid down in Article 324 of the revised text of the General Social Security Law.

8. The contribution bonuses provided for in this article shall be financed from the corresponding budget line of the Public State Employment Service and the reductions in contributions shall be borne by the social security revenue budget and by the mutual societies collaborating with the Social Security, respectively.

9. The benefits in the contributions provided for in this article will consist of a bonus in the case of self-employed or self-employed workers registered in the National Youth Guarantee System who meet the requirements established in article 105 of Law 18/2014, of 15 October, on the approval of urgent measures for growth, competitiveness and efficiency, applying said bonus in the same terms as the incentives provided for in paragraphs 1 to 3 and also being entitled to the additional bonus referred to in paragraph 4.

10. After the maximum period of enjoyment of the contribution benefits contemplated in this article, the contribution will proceed for all the protected contingencies from the first day of the month following the one that the end occurs.

Article 32. Benefits in social security contributions for people with disabilities, initial or over,victims of gender violence and victims of terrorism who establish themselves as self-employed

Social security contributions for self-employed or self-employed workers with a degree of disability equal to or greater than 33 per cent, victims of gender violence and victims of terrorism who cause initial discharge or who had not been in a situation of registration in the 2 years immediately preceding, counting from the date of effect of registration, in the Special Social Security Scheme for Self-Employed or Self-Employed Workers , shall be carried out as follows:

1. In the event that it is chosen to contribute for the corresponding minimum base, may benefit from a reduction in the contribution for common contingencies during the first 12 months immediately following the date of effect of the registration, which will consist of a single monthly fee of 60 euros, which will include both common contingencies and occupational contingencies, leaving these workers exempt from contributions for cessation of activity and professional training. Of this fee of 60 euros, 51.50 euros correspond to common contingencies and 8.50 euros to professional contingencies.

2. Alternatively, those self-employed or self-employed workers who, fulfilling the requirements set out in the previous section, opt for a contribution base higher than the minimum that corresponds, may apply during the first 12 months immediately following the date of effect of the registration, a reduction of 80% on the quota for common contingencies, being the quota to be reduced the resulting from applying to the minimum contribution base that corresponds to the contribution rate for common contingencies in force at all times.

After the initial period of 12 months provided for in the two previous sections, and regardless of the contribution base chosen, self-employed workers who benefit from the measure provided for in this article may apply a bonus on the quota for common contingencies, being the contribution to be subsidized the result of applying to the minimum contribution base that corresponds to 50 per cent of the result of applying to the base minimum contribution that corresponds to the rate of contribution for common contingencies in force at all times, for a maximum period of up to 48 months, until completing a maximum period of 5 years after the date of effect of registration.

3. In the event that the self-employed or self-employed worker resides and develops his activity in a municipality in whose municipal register updated at the beginning of the activity there are less than 5,000 inhabitants, after the initial period of 12 months of application of the benefits in the contribution established in the previous sections,you will be entitled during the 12 months following these same incentives. In these cases, the application of the 50 per cent bonus, provided for in the previous section, will be applied after the initial 24 months have elapsed, for a maximum period of up to 36 months, until completing a maximum period of 5 years from the date of effect of registration.

In order to benefit from these measures during the 12 months following the initial period, the self-employed or self-employed worker must:

- Be registered in a municipality of less than 5,000 inhabitants, according to the official data of the register in force at the time of registration in the Special Social Security Scheme for Self-Employed or Self-Employed Workers that causes the right to the incentive contemplated in this article.

- Be registered in the Census of Taxpayers of the State Agency of Tax Administration or the Foral Haciendas, corresponding the place of development of the declared activity to a municipality whose municipal register is less than 5,000 inhabitants.

- Maintain registration in the self-employed or self-employed activity in the aforementioned municipality in the two years following registration in the Special Social Security Scheme for Self-Employed or Self-Employed Workers that causes the right to the incentive contemplated in this article; as well as remain registered in the same municipality in the four years following said discharge.

The General Treasury of the Social Security will carry out the control of this reduction for which the National Institute of Statistics and the aforementioned Tax Administrations must make available to this Common Service the necessary means and information to verify compliance with the requirements required to benefit from this reduction.

In case of not fulfilling these requirements, the self-employed or self-employed worker must refund all the amounts left to pay by the application of the incentive, from the first day of the following month in which such non-compliance is accredited.

4. The period of withdrawal from the Special Social Security Scheme for Self-Employed or Self-Employed Workers, required in the previous sections to be entitled to the benefits in the contribution in them provided for in case of resuming a self-employed activity, will be 3 years when the self-employed workers had enjoyed said benefits in their previous period of registration in the aforementioned special regime.

5. In the event that the date of effect of the registrations referred to in paragraphs 1 to 3 does not coincide with the first day of the respective calendar month, the benefit corresponding to that month will be applied in proportion to the number of days of registration in it.

6. The provisions of the preceding paragraphs shall also apply, when they meet the requirements laid down therein, to self-employed workers who are included in the first contribution group of the Special Social Security Scheme for Sea Workers and to members of labour companies and to worker members of associated work cooperatives that are included in the Special Scheme for Workers’ Social Security. for Self-Employed or Self-Employed or in the Special Social Security Scheme for Sea Workers, within the first group of contributions.

7. The provisions of this Article shall apply even if the beneficiaries of this measure, once they have started their activity, employ employed persons.

8. The contribution bonuses provided for in this article shall be financed from the corresponding budget line of the State Public Employment Service and the reductions in contributions shall be borne by the social security revenue budget and by the mutual societies collaborating with the social security,respectively.

9. After the maximum period of enjoyment of the contribution benefits contemplated in this article, the contribution will proceed for all the protected contingencies from the first day of the month following the one that the end occurs.

10. The provisions of this article shall also apply, at the option of the interested parties, in the cases of self-employed workers who, while registered in this special scheme, are disabled to a degree equal to or greater than 33%.

In that case, the measures provided for in this Article shall be applied from the first day of the month following that in which the choice is made.’

Article 32 bis. Benefits in social security contributions for people with disabilities, initial or oversamore, victims of gender violence and victims of terrorism who establish themselves as self-employed workers included in the Special System for Self-Employed Agricultural Workers

The social security contributions of self-employed agricultural workers included in the Special System for Self-Employed Agricultural Workers with a degree of disability equal to or greater than 33 per cent, victims of gender violence and victims of terrorism, who cause initial discharge or who had not been in a situation of registration in the 2 years immediately preceding , from the date of effect of registration in said Special System, shall be carried out as follows:

1. In the event that they choose to contribute for the corresponding minimum base, they may benefit from a reduction in the contribution for common contingencies during the first 12 months immediately following the date of effects of the registration, which will consist of a single monthly fee of 50 euros, corresponding to common contingencies, leaving these workers exempt from contributions for cessation of activity and professional training.

2. Alternatively, those self-employed agricultural workers who, fulfilling the requirements laid down in the previous section, opt for a contribution base higher than the minimum that corresponds, may apply during the first 12 months immediately following the date of effect of the registration, a reduction of 80 per cent on the contribution for common contingencies , being the quota to be reduced the result of applying to the minimum contribution base that corresponds to the minimum contribution rate in force for common contingencies.

After the initial period of 12 months provided for in the two previous sections, and regardless of the contribution base chosen, self-employed workers who benefit from the measure provided for in this article may apply a bonus on the quota for common contingencies, being the contribution to be subsidized the result of applying to the minimum contribution base that corresponds to 50 per cent of the result of applying to the base minimum contribution that corresponds to the rate of contribution for common contingencies in force at all times, for a maximum period of up to 48 months, until completing a maximum period of 5 years after the date of effect of registration.

3. In the event that the self-employed agricultural worker resides and develops his activity in a municipality in whose updated municipal register at the beginning of the activity there are less than 5,000 inhabitants, after the initial period of 12 months of application of the benefits in the contribution established in the previous sections, he will be entitled during the 12 months following these same incentives. In these cases, the application of the bonus for 50 percent, provided for in the previous section, will be applied after the initial 24 months have elapsed, for a maximum period of up to 36 months, until completing a maximum period of 5 years from the date of effect of registration.

In order to benefit from these measures during the 12 months following the initial period, the self-employed agricultural worker must:

- Be registered in a municipality of less than 5,000 inhabitants, according to the official data of the register in force at the time of registration in the Special System for Self-Employed Agricultural Workers that causes the right to the incentive contemplated in this article.

- Be registered in the Census of Taxpayers of the State Agency of Tax Administration or the Foral Haciendas, corresponding the place of development of the declared activity to a municipality whose municipal register is less than 5,000 inhabitants.

- Maintain registration in the autonomous or self-employed activity in the aforementioned municipality in the two years following the registration in the Special System for Self-Employed Agricultural Workers that causes the right to the incentive contemplated in this article; as well as remain registered in the same municipality in the four years following said discharge.

The General Treasury of the Social Security will carry out the control of this reduction for which the National Institute of Statistics and the aforementioned Tax Administrations must make available to this Common Service the necessary means and information to verify compliance with the requirements required to benefit from this reduction.

In case of not fulfilling these requirements, the self-employed agricultural worker must refund all the amounts left to pay by the application of the incentive, from the first day of the following month in which such non-compliance is accredited.

4. The period of withdrawal from the Special System for Self-Employed Agricultural Workers required in the previous sections to be entitled to the benefits in the contribution in them provided for in case of resuming a self-employed activity, will be 3 years when the self-employed agricultural workers had enjoyed said benefits in their previous period of registration in the aforementioned special system.

5. In the event that the date of effect of the registrations referred to in paragraphs 1 to 4 does not coincide with the first day of the respective calendar month, the benefit corresponding to that month will be applied in proportion to the number of days of registration in it.

6. The provisions of this Article shall apply even if the beneficiaries of this measure, once they have started their activity, employ employed persons, within the limits laid down in Article 324 of the revised text of the General Social Security Law.

7. The contribution bonuses provided for in this article shall be financed from the corresponding budget line of the State Public Employment Service and the reductions in contributions shall be borne by the social security revenue budget and by the mutual societies collaborating with the social security, respectively.

8. After the maximum period of enjoyment of the contribution benefits contemplated in this article, the contribution will proceed for all the protected contingencies from the first day of the month following the one that the end occurs.

9. The provisions of this article shall also apply, at the option of the interested parties, in the cases of self-employed workers who, being registered in this special regime, have a disability to a degree equal to or greater than 33 per cent.

In that case, the measures provided for in this Article shall be applied from the first day of the month following that in which the choice is made.

Article 38 bis. Bonuses for self-employed women who return to work in certain cases

Workers included in the Special Social Security Scheme for Self-Employed Or Self-Employed Workers or as self-employed workers in the first contribution group of the Special Social Security Scheme for Sea Workers, who, having ceased their activity due to maternity, adoption, keep for the purpose of adoption , foster care and guardianship, in the legally established terms, return to carry out an activity on their own account within two years immediately following the effective date of the termination, they shall be entitled to a bonus under which their contribution to common contingencies and occupational contingencies,shall be fixed at the amount of 60 euros per month for the 12 months immediately following the date of their return to work, provided that they choose to contribute to the minimum base established in general in the special regime that corresponds by reason of the self-employed activity.

Those self-employed or self-employed workers who, fulfilling the above requirements, opt for a contribution base higher than the minimum indicated in the previous paragraph, may apply during the aforementioned period a bonus of 80 per cent on the contribution for common contingencies, being the quota to be reduced that resulting from applying to the minimum contribution base corresponding to the rate of contributions for common contingencies in force at all times.

Benefit for cessation of activity: legislative amendments (LGSS and LETA)

Until December 31, 2018: LGSS

Article 337. Application and birth of the right to protection for cessation of activity

1. Self-employed workers who meet the requirements established in Article 330 shall apply to the same mutual society collaborating with the Social Security to which they are attached the recognition of the right to protection for cessation of activity.

With regard to self-employed workers who are not members of a mutual society, the provisions of article 346.3 shall apply.

This recognition will imply the birth of the right to the enjoyment of the corresponding economic benefit, from the first day of the month immediately following that in which the event causing the cessation of activity occurred. When the economically dependent self-employed worker has ended his relationship with the main client, in order to be entitled to the enjoyment of the benefit, he will not be able to have activity with other clients from the day on which the collection of the benefit begins.

2. (…)

3. (…)

4. The managing body shall take charge of the social security contribution from the month immediately following that

of the event causing the cessation of activity,

provided that it has been requested within the period laid down in paragraph 2. Otherwise, the managing body shall take over from the month following that of the application.

When the economically dependent self-employed worker has ended his relationship with the main client, in the event that, in the month after the causal event, he had activity with other clients, the managing body will be obliged to contribute from the date of commencement of the benefit.

Article 338. Duration of the financial benefit

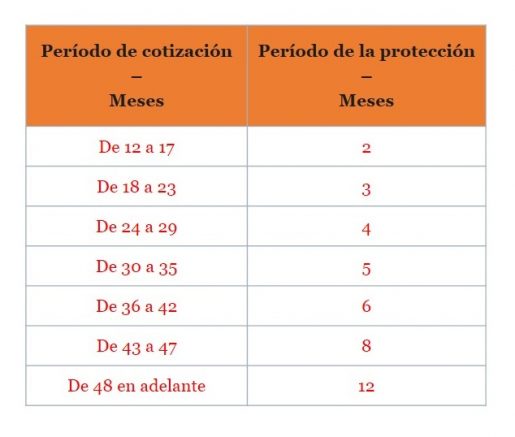

1. The duration of the benefit for cessation of activity will be in function of the periods of contribution made within the forty-eight months prior to the legal situation of cessation of activity of which, at least, twelve must be continued and immediately prior to said situation of cessation in accordance with the following scale :

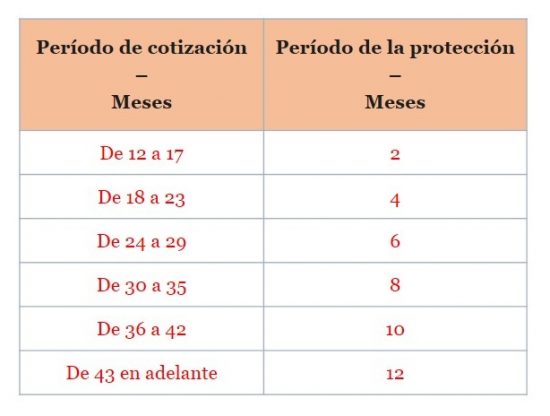

2. In accordance with the provisions of the second paragraph of the fourth additional provision of Law 20/2007, of 11 July, in the case of self-employed workers between the age of sixty and the age at which entitlement to the retirement pension may be caused, the duration of the benefit is increased in accordance with the following table:

2. In accordance with the provisions of the second paragraph of the fourth additional provision of Law 20/2007, of 11 July, in the case of self-employed workers between the age of sixty and the age at which entitlement to the retirement pension may be caused, the duration of the benefit is increased in accordance with the following table:

Article 340. Suspension of the right to protection

1. (…)

2. The suspension of the right will entail the interruption of the payment of the economic benefit and of the contribution for complete monthly payments without affecting the period of their collection, except in the case provided for in point (a) of the previous paragraph, in which the period of collection will be reduced by a time equal to that of the suspension produced.

Article 344. Financing, basis and type of contribution

1. The protection for cessation of activity shall be financed exclusively from the contribution for said contingency. The effective date of the cover shall begin on the first day of the same month in which it is formalised.

2. The contribution base for cessation of activity will correspond to the contribution base of the Special Scheme for Self-Employed or Self-Employed Workers that the self-employed worker has chosen as his own in accordance with the provisions of the applicable rules, or the one that corresponds to him as a self-employed worker in the Special Scheme for Sea Workers.

3. The contribution rate corresponding to the social security protection for cessation of activity, applicable to the base determined in the previous section, shall be established in accordance with the provisions of Article 19. However, in order to maintain the financial sustainability of the protection system, the General State Budget Law for each financial year shall establish the contribution rate applicable to the financial year to which they relate in accordance with the following rules:

a) The contribution rate expressed as much per cent shall be that resulting from the following formula: TCt = G /BC*100

- being:

- t = year to which the General State Budgets refer in which the new contribution rate will be in force.

- TCt = contribution rate applicable for year t.

- G = sum of expenditure on cessation of activity benefits for the months from 1 August of year t-2 to 31 July of year t-1

- BC= sum of the contribution bases for cessation of activity for the months from August 1 of year t-2 to July 31 of year t-1.

(b) Notwithstanding the foregoing, it shall not be appropriate to apply the rate resulting from the formula, while maintaining the current rate, where:

- Involve increasing the current contribution rate by less than 0.5 percentage points.

- Involve reducing the current contribution rate by less than 0.5 percentage points, or when the reduction of the rate greater than 0.5 percentage points is the reserves of this benefit referred to in article 346.2 foreseen at the end of year t–1 do not exceed the expense budgeted for the cessation of activity benefit for year t.

c) In any case, the contribution rate to be fixed annually may not be less than 2.2% or more than 4%.

When the contribution rate to be fixed in application of the provisions of this section exceeds 4 per cent, all the grace periods provided for in article 338.1 of this Law will necessarily be revised upwards, which will be fixed in the corresponding General State Budget Law. This upward revision will be at least two months.

4. The Independent Authority for Fiscal Responsibility may issue an opinion, in accordance with the provisions of article 23 of Organic Law 6/2013, of 14 November, on the creation of the Independent Authority for Fiscal Responsibility, regarding the application by the Ministry of Employment and Social Security of the provisions of the previous sections, as well as regarding the financial sustainability of the protection system for cessation of activity.

5. The measures of training, professional guidance and promotion of the entrepreneurial activity of self-employed workers benefiting from the protection for cessation of activity, referred to in article 329.2 of this Law, shall be financed with 1 per cent of the income established in this article. These measures shall be managed by the public employment service of the competent autonomous community and by the Social Marine Institute, in proportion to the number of beneficiaries they manage.

Article 347. Obligations of self-employed workers

1. The following are the obligations of self-employed workers applying for and benefiting from cessation of activity protection:

- a) Request the same mutual society collaborating with the Social Security

with which they have agreed the professional contingencies

the coverage of the protection for cessation of activity. - b) Contribute for the contribution corresponding to the protection for cessation of activity.

- c) Provide the documentation and information that are necessary for the purposes of recognition, suspension, termination or resumption of the service.

- d) Request the withdrawal of the benefit for cessation of activity when situations of suspension or extinction of the right occur or the requirements required for its collection are no longer met, at the time when such situations occur.

- e) Not to work as a self-employed or employed person during the receipt of the benefit.

- (f) Reimbursement of benefits unduly received.

- g) Appear at the request of the managing body and be at the disposal of the public employment service of the corresponding autonomous community, or the Social Institute of the Navy, in order to carry out the training activities, professional guidance and promotion of entrepreneurial activity to which they are summoned.

- h) Participate in specific actions of motivation, information, orientation, training, reconversion or professional insertion to increase their employability that are determined by the managing body, by the public employment service of the corresponding autonomous community, or by the Social Institute of the Navy, where appropriate.

Article 350. Competent jurisdiction and prior claim

The courts of the social order shall be competent to hear and determine the decisions of the managing body relating to the recognition, suspension or termination of benefits for cessation of activity, as well as the payment thereof.

Irrespective of the provisions of Article 346(3),

the interested party may make a prior complaint to the managing body before going to the competent social court. The resolution of the managing body must expressly indicate the possibility of submitting a claim, as well as the time limit for its filing.

Until December 31, 2018: LETA

Fourth additional provision. Cessation of activity benefit

The Government, provided that the principles of contributory, solidarity and financial sustainability are guaranteed and this responds to the needs and preferences of self-employed workers, will propose to the Cortes Generales the regulation of a specific system of protection for cessation of activity for them, depending on their personal characteristics or the nature of the activity carried out.

The articulation of the benefit for cessation of activity will be carried out in such a way that, in the cases in which it must be applied at ages close to the legal retirement, its application guarantees, in combination with the measures of anticipation of the retirement age in specific circumstances contemplated in the General Law of the Social Security , that the level of protection provided is the same, in equivalent cases of contribution career, contributory effort and causality, as that of employed workers, without this implying additional costs at the non-contributory level.

Public administrations may, for duly justified economic policy reasons, co-finance cessation of activity plans aimed at specific groups or economic sectors.

As of January 1, 2019: LGSS

Article 337. Application and birth of the right to protection for cessation of activity

1. Self-employed workers who meet the requirements established in Article 330 shall apply to the same mutual society collaborating with the Social Security to which they are attached the recognition of the right to protection for cessation of activity.

In the case of self-employed persons who are not members of a mutual society, the provisions of Article 346(3) shall apply.

The right to receive the corresponding economic benefit will arise from the day following that on which the withdrawal from the special regime to which they were attached takes effect, in accordance with article 46. 4 a) of the General Regulation on registration of companies and affiliation, registration, cancellation and variations of data of workers in the Social Security, approved by Royal Decree 84/1996, of 26 January.

In the other cases regulated in the same article, the right shall be desicing the right on the first day of the month following that in which it has downward effects as a result of the cessation of activity.

When the economically dependent self-employed worker has ended his relationship with the main client, in order to be entitled to receive the benefit, he may not have activity with other clients from the day on which he begins the collection of the benefit.

2. (…)

3. (…)

4. The managing body shall be responsible for the Social Security contribution during the period of receipt of the benefit, provided that it has been requested within the period provided for in paragraph 2. Otherwise, the managing body shall take over from the first day of the month following that of the application.

When the economically dependent self-employed worker has ended his relationship with the main client, in the event that, in the month after the causal event, he had activity with other clients, the managing body will be obliged to contribute from the date of commencement of the benefit.

Article 338. Duration of the financial benefit

1. The duration of the benefit for cessation of activity will be in function of the periods of contribution made within the forty-eight months prior to the legal situation of cessation of activity of which, at least, twelve must be continued and immediately prior to said situation of cessation in accordance with the following scale :

2. REMOVED

2. REMOVED

Article 340. Suspension of the right to protection

1. (…)

2. The suspension of the right will entail the interruption of the payment of the economic benefit and the contribution without affecting the period of its collection, except in the case provided for in point (a) of the previous paragraph, in which the period of receipt will be reduced by the same time as the suspension produced.

Article 344. Financing, basis and type of contribution

1. The protection for cessation of activity shall be financed exclusively from the contribution for said contingency. The date of effect of the cover shall be determined by regulation.

2. The contribution base for cessation of activity will correspond to the contribution base of the Special Scheme for Self-Employed or Self-Employed Workers that the self-employed worker has chosen as his own in accordance with the provisions of the applicable rules, or the one that corresponds to him as a self-employed worker in the Special Scheme for Sea Workers.

3. The contribution rate corresponding to the social security protection for cessation of activity, applicable to the base determined in the previous section, shall be established in accordance with the provisions of Article 19. However, in order to maintain the financial sustainability of the protection system, the General State Budget Law for each financial year shall establish the contribution rate applicable to the financial year to which they relate in accordance with the following rules:

a) The contribution rate expressed as much per cent shall be that resulting from the following formula: TCt = G/BC*100

- being:

- t = year to which the General State Budgets refer in which the new contribution rate will be in force.

- TCt = contribution rate applicable for year t.

- G = sum of expenditure on cessation of activity benefits for the months from 1 August of year t-2 to 31 July of year t-1

- BC = sum of the contribution bases for cessation of activity for the months from August 1 of year t-2 to July 31 of year t-1.

(b) Notwithstanding the foregoing, it shall not be appropriate to apply the rate resulting from the formula, while maintaining the current rate, where:

- Involve increasing the current contribution rate by less than 0.5 percentage points.

- Involve reducing the current contribution rate by less than 0.5 percentage points, or when the reduction of the rate greater than 0.5 percentage points is the reserves of this benefit referred to in article 346.2 foreseen at the end of year t–1 do not exceed the expense budgeted for the cessation of activity benefit for year t.

(c) In any event, the rate of contribution to be fixed annually may not be less than 0,7% or more than 4%.

When the contribution rate to be fixed in application of the provisions of this section exceeds 4 per cent, all the grace periods provided for in article 338.1 of this Law will necessarily be revised upwards, which will be fixed in the corresponding General State Budget Law. This upward revision will be at least two months.

4. The Independent Authority for Fiscal Responsibility may issue an opinion, in accordance with the provisions of article 23 of Organic Law 6/2013, of 14 November, on the creation of the Independent Authority for Fiscal Responsibility, regarding the application by the Ministry of Labour, Migration and Social Security of the provisions of the previous sections, as well as with regard to the financial sustainability of the protection system for cessation of activity.”

Article 347. Obligations of self-employed workers

1. The following are the obligations of self-employed workers applying for and benefiting from cessation of activity protection:

- a) Request from the same mutual society collaborating with the Social Security to which they are attached the coverage of the protection for cessation of activity.

- b) Contribute for the contribution corresponding to the protection for cessation of activity.

- c) Provide the documentation and information that are necessary for the purposes of recognition, suspension, termination or resumption of the service.

- d) Request the withdrawal of the benefit for cessation of activity when situations of suspension or extinction of the right occur or the requirements required for its collection are no longer met, at the time when such situations occur.

- e) Not to work as a self-employed or employed person during the receipt of the benefit.

- (f) Reimbursement of benefits unduly received.

- (g) and h) DELETED

Article 350. Competent jurisdiction and prior claim

1. The courts of the social order shall be competent to hear and determine the decisions of the managing body concerning the recognition, suspension or termination of benefits for cessation of activity and the payment thereof. The interested party may make a prior complaint to the managing body before going to the competent social court. The decision of the managing body must expressly indicate the possibility of submitting a claim, the body before which it must be filed,as well as the time limit for its filing.

2. When a prior complaint is made against the decisions of the mutual societies collaborating with the Social Security in the field of benefits for cessation of activity, before their resolution, a binding report shall be issued by a joint committee in which the mutual societies collaborating with the Social Security, the representative associations of self-employed workers and the Social Security Administration will be represented. The chairman of the committee shall be the representative of the Social Security Administration and a person in the service of the mutual society competent to decide shall act as secretary not a member of the committee. A lawyer of the Social Security Administration integrated into the Legal Service of the Social Security Administration may be part of the commission, as an adviser with voice but without vote.

The mutual society responsible for deciding shall forward to the committee, for its decision, the reasoned proposal for the resolution of the previous complaint. The registrar shall draw up minutes of each meeting, stating the agreements reached, and shall also make communications between the committee and the mutual society responsible. Mutual societies must provide the necessary financial and administrative support for the functioning of the commission by signing the appropriate agreements. By means of a resolution of the Secretary of State for Social Security, the determination of the composition, organization and other precise points for the proper functioning of said commission will be established, applying, in the unforeseen, the provisions for the functioning of the collegiate bodies in Law 40/2015, of October 1, on the Legal Regime of the Public Sector.

The rest of the previous complaints will be resolved by the same managing body that issued the contested decision.

As of January 1, 2019: LETA

Fourth additional provision. Cessation of activity benefit

The Government, provided that the principles of contributory, solidarity and financial sustainability are guaranteed and this responds to the needs and preferences of self-employed workers, will propose to the Cortes Generales the regulation of a specific system of protection for cessation of activity for them, depending on their personal characteristics or the nature of the activity carried out.

ALL OTHER TEXTS DELETED

Cessation of activity benefit

Requirements

- Be at the date of cessation of activity affiliates, and registered in the RETA or REM;

- request the withdrawal from the RETA due to the cessation of activity;

- grace period: 12 months continuous and immediately preceding the situation of cessation, taking into account for this purpose the month in which it occurs;

- be in a legal situation of cessation of activity, sign the commitment of activity and prove active availability for the return to the labor market;

- not having reached the ordinary retirement age, unless the self-employed worker did not have the required contribution period accredited.

- be up-to-date in the payment of contributions, without prejudice to the possibility of invitation to payment.

Legal situation of cessation of activity

- losses exceeding 10% in a period of 1 year, excluding the first year of activity;

- judicial or administrative executions aimed at the recovery of debts, representing at least 30% of the income of the previous year;

- judicial declaration of competition;

- force majeure;

- loss of administrative leave not motivated by criminal offences;

- gender-based violence

- divorce or marital separation, when the divorced or separated self-employed person exercises family support functions in the business of his former spouse

- involuntary termination of the position of director or administrator of a commercial company when the latter has losses of more than 10% in a period of 1 year, excluding the first year of activity;

- termination of the TRADE contract by:

- end of the duration of the contract or of the work or service;

- serious breach of contract of the client;

- termination of the client for just cause;

- death, disability or retirement of the client that prevents the continuation of the activity.

benefit

- Economic benefit: consists of 70% of the BR. With a maximum or minimum amount that depends on family responsibilities:

- maximum amount: no dependent children: 175% of the IPREM; with one dependent child: 200% of the IPREM; and with more than one dependent child: 225% of the IPREM.

- minimum amount: no dependent children: 80% of the IPREM; with dependent children: 107% of the IPREM.