The Tax Agency makes available the online service for calculating personal work withholdings for the 2019 financial year.

Calculation of withholdings in 2019

The online service for calculating personal work withholdings for the 2019 financial year is available on the Tax Agency’swebsite.

For the calculation of the withholdings,the:

- personal data of the worker: NIF, date of birth, family situation and family situation;

- family data of the worker: ascendants and dependent descendants;

- economic data: annual gross remuneration, reductions and deductible expenses among which the social security contributions borne must be included;

- regularization data.

Once the data is entered, the“Results”tab automatically displays the applicable retention type.

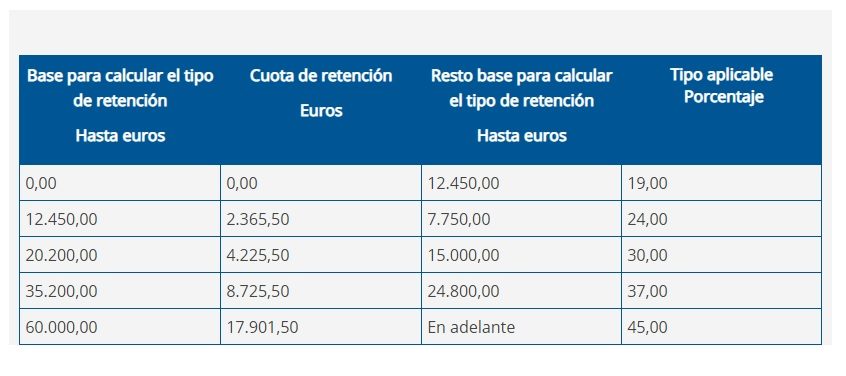

Table of withholdings and income on account

Below we detail the table of withholdings and income on account that has been set for this year, 2019:

Information circular on types of retention

Applicable retention type

In the monthly payroll, workers support the withholding on account of personal income tax. The type of withholding is determined in each case according to the expected salary and the personal and family circumstances communicated by the worker when signing the contract and in form 145 that the company circulates at the beginning of each year.

Therefore, if the personal circumstances that the company takes into account to calculate your type of withholding have been modified, please return form 145 duly completed with your updated personal and family data.

Modification of retention types (reduction)

During the year, workers may inform the company of changes in their personal or family circumstances that imply a lower type of retention. The most common causes that cause a reduction in the type of retention are as follows:

- Increase in the number of descendants or variation in their circumstances (e.g. if a disability arises).

- When by court decision, the worker is obliged to pay a compensatory pension to his spouse or annuities for maintenance to his children.

- Variation in the number of ascendants who live with the worker.

- If in the course of the calendar year the worker allocates amounts to acquire or rehabilitate his habitual residence using external financing and with the right to deduction in his Personal Income Tax, provided that the total amount of remuneration is less than 33,007.20 euros.

Modification of retention rates (increase)

During the year, workers must inform the company of changes in their personal or family circumstances, which imply a higher type of retention. The most common causes that cause an increase in the type of retention are as follows:

- If in the course of the calendar year the spouse of the taxpayer begins to obtain incomes greater than 1,500 euros per year (unless they are income exempt from personal income tax).

- Variation in the number of ascendants who live with the worker.

- If during the calendar year the financing of others destined to the acquisition or rehabilitation of the main residence is stopped.

How to calculate withholdings

At the beginning of the year, workers’ withholdings must be calculated. How should you do it? Are you obliged to ask your staff for the 145 model?

To calculate the type of withholding of a worker you must take into account the income forecast and the family situation.

To get the annual revenue forecast:

- Compute your annual fixed salary (multiplying the fixed monthly salary by 12 and adding the extra pay, provided they are not prorated), and add the variable remuneration that you are expected to receive. For these purposes, compute at least the variable of the previous year, unless there are objective elements that allow you to prove that the new year will be lower.

- If you pay wages in kind,include them in the income forecast based on your valuation for tax purposes.

The type of withholding also depends on the personal and family situation of the employees. Therefore, it is important that at the beginning of the contract and at the beginning of each year you are given form 145, indicating your personal data. For this purpose:

- If an employee has already given you form 145 – the normal thing is that they did it when formalizing the contract – it is not necessary that every year you give it to them again; it will only be necessary if their personal circumstances are modified.

- If you do not have form 145 for any reason, calculate your withholding considering that your family situation is 3 (unmarried) and that you have no children or ascendants.

- Likewise, if a worker enters data that are not true (for example, indicates that he has children but you know that he does not have them), he calculates his withholding based on the data provided (it will be the worker who has to answer to the Treasury).

To have the data updated, it is advisable to deliver at the beginning of the year, a circular to the staff (explaining that you need such data to calculate their retentions), along with a copy of form 145.

It forecasts as variable revenues those of the previous year. It is not necessary for employees to deliver form 145 every year, unless circumstances change.

If you have any questions about the withholdings you have to apply to your employees, you can contact us and our team of labor advisors will be in charge of helping you.