Royal Decree Law 28/2018 has been published, which establishes the revaluation of public pensions for 2019, as well as the updating of contribution bases in all Social Security schemes. In addition, it includes the extension of the scope of protection of the Special Regime for the Self-Employed, as well as important modifications in labor and Social Security matters.

Notable measures

In accordance with the provisions of article 134.4 of the Constitution, not having approved before January 1, 2019 the Law of General State Budgets for this year, the Budgets of the previous year, approved by 6/2018, are automatically extended until the approval of the new ones. However, Royal Decree Law 28/2018 introduces urgent measures in social, labor and employment matters that must be taken into account as of January 1, 2019.

The most relevant developments occur in the following areas:

I. Social security

(a) Revaluation of pensionswith effect from January 1, 2019 and establishment of an extra payment before April 1, 2019.

(b) Newlisting rules, among which stand out: the increase of the contribution bases for 2019 in all social security schemes; modification of the premium rate and new types of contributions for certain groups, among others, short-term jobs. In addition, the application of the prevention bonus is suspended.

(c) Inclusion in the General Social Security Scheme (RGSS) of people who develop training programsand non-labor and academic practices. Inclusion is carried out assimilated to employed persons, excluding unemployment protection. The contribution is made applying the rules corresponding to the contracts for training and apprenticeship, without there being any obligation to contribute for unemployment, FOGASA or FP. If the practice or training is carried out on board a vessel, the inclusion occurs in the Special Regime of the Sea.

d) Introduction of a new case ofspecialagreementwith the General Taxation of the Social Security (TGSS) for those affected by the crisis. This special agreement will allow those who prove an age between 35 and 43 years and a contribution gap of at least 3 years between October 2, 2008 and July 1, 2018, to recover a maximum of 2 years of contributions for the purposes of permanent disability benefits , retirement and death and survival. The measure will enter into force when it is developed by regulation.

(e) The modality of voluntary collaboration in the management of the Social Security is abolished,by means of which the companies assumed directly the payment, at their expense, of the economic benefits forTemporary Disability(TD) derived from common contingencies. Companies that, on December 31, 2018, were covered by this type of collaboration must have ceased in it on March 31, 2019, establishing the following transitional rules:

- within 3 months of the termination, they must settle the operations relating to the collaboration;

- the responsibility for the payment of the subsidy for the IT processes that are in progress at the date of the cessation, remains with the collaborating company until the extinction of the TD, or for the prolongation of its effects, without the company being able to compensate itself in the settlements of contributions;

- companies can choose, until 1-4-2019, to formalize the protection of TD derived from common contingencies with a mutual collaborator with the Social Security.

(f) With regard tounemployment protection,the following new features stand out:

- the number of actual working hours needed to access unemployment benefit or agricultural income for temporary agricultural workers residing in the provinces of Malaga, Seville and Cadiz declared as “areas seriously affected by a civil protection emergency” is reduced. For these workers it is required to have a minimum of 20 real days of contributions in the 12 calendar months immediately prior to the unemployment situation. The same number of real days is required for those who reside in Andalusia or Extremadura and prove the realization of the real days in the affected provinces in the 12 calendar months immediately prior to January 1, 2019. Those who submitted their application between October 1, 2018 and December 31, 2012 must submit a new application within the stated period.

- the temporary nature of the extraordinary unemployment benefit, until now linked to an unemployment rate of more than 15%, is eliminated to ensure the coverage of the beneficiaries until it is replaced by a new model of assistance unemployment protection that is expected to be adopted during the first 4 months of 2019.

Ⅱ. Autonomous

The protection of self-employed or self-employed workers is extended by joining the RETA, in a mandatory way, all contingencies that until now were voluntary, such as protection for cessation of activity and professional contingencies.

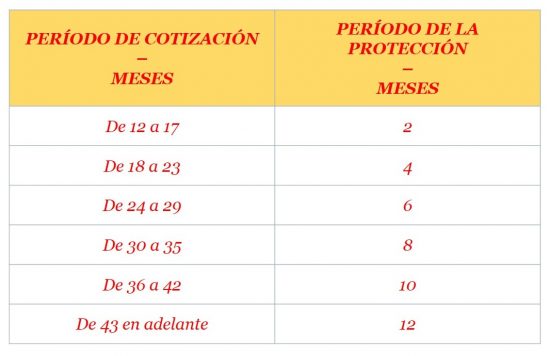

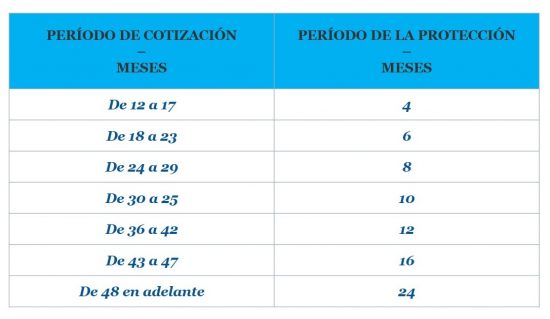

In addition, the regulation of the cessation of activity is reformed, doubling the period of receipt of its payment with respect to that provided for now.

In terms of contributions, the bases are increased by 1.25% and the flat rate is extended to the special system of self-employed agricultural workers.

On the other hand, the fight against the fraudulent use of the figure of the self-employed worker is strengthened by the creation of a new type of serious infraction that penalizes this conduct.

Iii. Labour and employment measures

The main developments concern the following issues:

(a) Rules for affecting the amounts of the Minimum Interprofessional Wage (SMI)to collective agreements. The amounts of the SMI for 2019, which have meant an increase of 22.30% with respect to those established for 2018, will not be applicable for collective agreements that use the SMI as a reference to determine the amount or increase of the base salary or salary supplements. In these cases, the references to the SMI should be understood as referring to the following amounts:

- collective agreements in force on 1-1-2017: to the SMI 2016 + 2%;

- collective agreements that entered into force after 1 January 2017 and that remained in force as of 26 December 2017: SMI 2017 + 2%;

- collective agreements that entered into force after December 26, 2017: SMI 2018.

However, wages established in a collective agreement that are lower, as a whole and in annual calculation, than the SMI set for 2019, must be increased by the amount necessary to ensure the receipt of said SMI.

(b) The possibility of establishing, by means of collective bargaining, forced retirement clauses is recovered, provided that the following requirementsare met:

- that the worker meets the necessary requirements to access 100% of the contributory retirement pension;

- that the measure be linked to employment policies such as the transformation of temporary contracts into permanent ones, the hiring of new workers, the generational changeover or any other measure aimed at promoting the quality of employment.

(c) Very short-term contracts. In order to combat temporary employment, the employer’s contributionto the Social Security for common contingencies of contracts of less than 5 days duration whose provision of services begins from January 1, 2019. Until now, an increase of 36% has been established in respect of contracts of less than 7 years’ duration.

In these cases, each day worked will be considered as 1.4 days of contributions for the sole purpose of accrediting the period of lack of retirement benefits, permanent disability, death and survival, Temporary Disability, maternity and paternity and care of children affected by cancer or other serious illness. In no case can a number of days greater than that corresponding to the respective month be computed monthly).

(d) Contracts linked to an unemployment rate of more than 15% are repealed. As of January 1, 2019, the following contracts can no longer be concluded:

- indefinite contract of support to entrepreneurs;

- contracts for training and apprenticeship with workers under the age of 30.

- the incentives to hiring provided for in Law 11/2013 for the part-time contract with training ties, indefinite hiring of a young person by microenterprises and self-employed entrepreneurs, hiring in new projects of young entrepreneurship, contract of first young employment and incentives to the contracts in practices.

- the accompanying financial aid of the national youth guarantee system, however, the possibility of receiving it is maintained for those who already had the status of beneficiaries of this aid before January 1, 2019.

Royal Decree Law 28/2018 is structured in two titles dedicated to social security measures, the first, and measures in labor and employment matters, the second. In addition, it includes 7 additional provisions, 8 transitional provisions, a derogatory provision and 5 final provisions amending, among other normative texts, the Workers’ Statute, the General Social Security Law, Law 20/2007 on the Statute of Self-Employment (LETA), lisos, the premium rate for contributions for work accidents and occupational diseases (L 42/2006 disp.adic.4ª) and the Law on Passive Classes of the State (RDLeg 670/1987).

Amendments to the Statute of Self-Employment (LETA)

>> UNTIL DECEMBER 31, 2018 <<

Article 26. Protective action

1. The protective action of the Special Social Security Scheme for Self-Employed Or Self-Employed Workers, under the terms and in accordance with the legally provided conditions, shall include, in any case:

- (a) Health care in cases of maternity, common or occupational disease and accidents, whether or not they are at work.

- (b) Financial benefits in situations of temporary disability, risk during pregnancy, maternity, paternity, risk during breastfeeding, permanent disability, retirement, death and survival and dependent family members.

2. (…)

3. Economically dependent self-employed workers must incorporate, within the scope of the social security protection action, the social security cover for temporary disability and accidents at work and occupational diseases.

For the purposes of this coverage, an accident at work shall be understood as any bodily injury suffered by the economically dependent self-employed worker who suffers on the occasion or as a result of the professional activity, and an accident at work is also considered to be that suffered by the worker when he or she goes to or return from the place where the activity is provided, or by cause or consequence thereof. Unless there is proof to the contrary, the accident shall be presumed to be unrelated to work when it occurred outside the course of the professional activity in question.

Article 31. Reductions and bonuses in social security contributions applicable to self-employed persons

1. Self-employed or self-employed workers who cause initial registration or who had not been in a situation of registration in the 2 years immediately preceding, counting from the date of effect of registration, in the Special Social Security Scheme for Self-Employed or Self-Employed Workers, will be entitled to a reduction in the contribution for common contingencies, including temporary disability, which will be fixed at the amount of 50 euros per month during the 12 months immediately following the date of effect of the registration, in the event that they choose to contribute for the minimum base that corresponds to them.

Alternatively, those self-employed or self-employed who, complying with the requisitos provided for in the previous paragraph, opt for a contribution base higher than the minimum that corresponds to them, may be applied during the first 12 months immediately following the date of effect of the registration, a reduction of 80% on the quota for common contingencies,being the quota to be reduced the resulting from applying to the minimum contribution base that corresponds to the corresponding minimum contribution rate in force at all times, including temporary disability.

After the initial period of 12 months provided for in the previous two paragraphs, and regardless of the contribution base chosen, self-employed workers who benefit from the measure provided for in this article may apply the following reductions and bonuses on the contribution for common contingencies, being the quota to be reduced or subsidized the result of applying to the minimum contribution base that corresponds to the minimum contribution rate in force at any given time , including temporary disability, for a maximum period of up to 12 months, until completing a maximum period of 24 months after the date of effect of discharge, according to the following scale:

- a) A reduction equivalent to 50% of the quota during the 6 months following the initial period provided for in the first two paragraphs of this paragraph.

- (b) A reduction equivalent to 30% of the quota during the 3 months following the period referred to in point (a).

- c) A bonus equivalent to 30% of the quota for the 3 months following the period referred to in point (b).

In the event that the self-employed or self-employed worker resides and develops his activity in a municipality in whose updated municipal register at the beginning of the activity there are less than 5,000 inhabitants, after the initial period of 12 months of application of reductions in the contributions for common contingencies, including temporary disability, established in the first two paragraphs of this section , you will be entitled for the next 12 months to these same incentives. In these cases, the reductions and bonuses for the 12 months following the initial period referred to in the preceding letters shall not apply.

In order to benefit from these reductions during the 12 months following the initial period, the self-employed or self-employed worker must:

- Be registered in a municipality of less than 5,000 inhabitants, according to the official data of the register in force at the time of registration in the Special Social Security Scheme for Self-Employed or Self-Employed Workers that causes the right to the incentive contemplated in this article.

- Be registered in the Census of Taxpayers of the State Agency of Tax Administration or the Foral Haciendas, corresponding the place of development of the declared activity to a municipality whose municipal register is less than 5,000 inhabitants.

- Maintain registration in the self-employed or self-employed activity in the aforementioned municipality in the two years following registration in the Special Social Security Scheme for Self-Employed or Self-Employed Workers that causes the right to the incentive contemplated in this article; as well as remain registered in the same municipality in the four years following said discharge.

The General Treasury of the Social Security will carry out the control of this reduction for which the National Institute of Statistics and the aforementioned Tax Administrations must make available to this Common Service the necessary means and information to verify compliance with the requirements required to benefit from this reduction.

In case of not fulfilling these requirements, the self-employed or self-employed worker must refund all the amounts left to pay by the application of the incentive, from the first day of the following month in which such non-compliance is accredited.

2. In the event that the self-employed workers are under 30 years of age, or under 35 years of age in the case of women, and cause initial registration or have not been in a situation of affiliation in the 2 years immediately preceding, counting from the date of effect of registration, in the Special Social Security Scheme for Self-Employed or Self-Employed Workers , may be applied, in addition to the reductions and bonuses provided for in the previous section, an additional bonus equivalent to 30%, on the quota for common contingencies, in the 12 months following the end of the period of bonus provided for in paragraph 1, the bonus being the one resulting from applying to the minimum contribution base corresponding to the tipo minimum contribution in force at all times, including temporary disability. In this case the maximum duration of the reductions and bonuses it will be 36 months.

3. The period of withdrawal from the Special Social Security Scheme for Self-Employed or Self-Employed Workers, required in the previous sections to be entitled to the benefits in the contribution in them provided for in case of resuming a self-employed activity, will be 3 years when the self-employed workers had enjoyed said benefits in their previous period of registration in the aforementioned special regime.

4. In the event that the date of effect of the registrations referred to in paragraphs 1 and 2 does not coincide with the first day of the respective calendar month, the benefit corresponding to that month will be applied in proportion to the number of days of registration in it.

5. The provisions of the preceding paragraphs shall also apply, when they meet the requirements laid down therein, to self-employed workers who are included in the first contribution group of the Special Social Security Scheme for Sea Workers and to members of labour companies and to worker members of associated work cooperatives that are included in the Special Scheme for Workers’ Social Security. for Self-Employed or Self-Employed or in the Special Social Security Scheme for Sea Workers, within the first group of contributions.

6. The provisions of this Article shall apply even if the beneficiaries of this measure, once they have started their activity, employ employed persons.

7. The contribution bonuses provided for in this article shall be financed from the corresponding budget line of the State Public Employment Service and the reductions in contributions shall be borne by the social security revenue budget, respectively.

8. The benefits in the contributions provided for in this article will consist of a bonus in the case of self-employed or self-employed workers registered in the National Youth Guarantee System who meet the requirements established in article 105 of Law 18/2014, of 15 October, on the approval of urgent measures for growth, competitiveness and efficiency, applying this bonus in the same terms as the incentives provided for in paragraph 1 and also being entitled to the additional bonus referred to in paragraph 2.

Article 32. Reductions and bonuses of social security contributions for people with disabilities, victims of gender-based violence and victims of terrorism who establish themselves as self-employed

1. The fee for common contingencies, including temporary disability, of people with a degree of disability equal to or greater than 33%, victims of gender violence and victims of terrorism, who cause initial discharge or who had not been in a situation of affiliation in the 2 years immediately preceding, counting from the date of effect of registration, in the Special Social Security Scheme for Self-Employed or Self-Employed Workers , it will be reduced to the amount of 50 euros per month during the 12 months immediately following the date of effect of the registration, in the event that they choose to contribute for the minimum base that corresponds to them.

Alternatively, those self-employed or self-employed workers who, fulfilling the requirements set out in the previous paragraph, opted for a contribution base higher than the minimum that corresponds to them, may apply during the first 12 months immediately following the date of effect of the registration, a reduction on the quota for common contingencies, being the quota to be reduced 80 per cent of the result of applying to the corresponding minimum contribution base the minimum contribution rate in force at any given time, including temporary disability.

After the initial period of 12 months provided for in the two preceding paragraphs, and regardless of the contribution base chosen, self-employed workers who benefit from the measure provided for in this article may apply a bonus on the contribution for common contingencies, the contribution to be subsidized being 50% of the result of applying to the minimum contribution base that corresponds to the minimum contribution rate in force at any given time , including temporary disability, for a maximum period of up to 48 months, until completing a maximum period of 5 years from the date of effect of discharge.

In the event that the self-employed or self-employed worker resides and develops his activity in a municipality in whose updated municipal register at the beginning of the activity there are less than 5,000 inhabitants, after the initial period of 12 months of application of reductions in contributions for common contingencies, including temporary disability, established in the first two paragraphs of this paragraph, shall be entitled during the 12 months following these same incentives. In these cases, the application of the 50 per cent bonus provided for in the previous paragraph shall be applied, once the initial 24 months have elapsed, for a maximum period of up to 36 months, until a maximum period of 5 years from the date of effect of registration has been completed.

In order to benefit from these reductions during the 12 months following the initial period, the self-employed or self-employed worker must:

- Be registered in a municipality of less than 5,000 inhabitants, according to the official data of the register in force at the time of registration in the Special Social Security Scheme for Self-Employed or Self-Employed Workers that causes the right to the incentive contemplated in this article.

- Be registered in the Census of Taxpayers of the State Agency of Tax Administration or the Foral Haciendas, corresponding the place of development of the declared activity to a municipality whose municipal register is less than 5,000 inhabitants.

- Maintain registration in the self-employed or self-employed activity in the aforementioned municipality in the two years following registration in the Special Social Security Scheme for Self-Employed or Self-Employed Workers that causes the right to the incentive contemplated in this article; as well as remain registered in the same municipality in the four years following said discharge.

The General Treasury of the Social Security will carry out the control of this reduction for which the National Institute of Statistics and the aforementioned Tax Administrations must make available to this Common Service the necessary means and information to verify compliance with the requirements required to benefit from this reduction.

In case of not fulfilling these requirements, the self-employed or self-employed worker must refund all the amounts left to pay by the application of the incentive, from the first day of the following month in which such non-compliance is accredited.

2. The period of withdrawal from the Special Social Security Scheme for Self-Employed or Self-Employed Workers, required in the previous section to be entitled to the benefits in the contribution in it provided for in case of resuming a self-employed activity, will be 3 years when the self-employed workers had enjoyed said benefits in their previous period of registration in the aforementioned special scheme.

3. In the event that the date of effect of the registrations referred to in paragraph 1 does not coincide with the first day of the respective calendar month, the benefit corresponding to that month shall be applied in proportion to the number of days of registration in it.

4. The provisions of the preceding paragraphs shall also apply, when they meet the requirements laid down therein, to self-employed workers who are included in the first contribution group of the Special Social Security Scheme for Sea Workers and to members of labour companies and to worker members of associated work cooperatives that are included in the Special Scheme for Workers’ Social Security. for Self-Employed or Self-Employed or in the Special Social Security Scheme for Sea Workers, within the first group of contributions.

5. The provisions of this Article shall apply even if the beneficiaries of this measure, once they have started their activity, employ employed persons.

6. The contribution bonuses provided for in this Article shall be financed from the corresponding budget line of the State Public Employment Service and the reductions in contributions shall be borne by the social security revenue budget, respectively.

Article 38 bis. Bonuses for self-employed women who return to work in certain cases

Workers included in the Special Social Security Scheme for Self-Employed Or Self-Employed Workers or as self-employed workers in the first contribution group of the Special Social Security Scheme for Sea Workers, who, having ceased their activity due to maternity, adoption, keep for the purpose of adoption , foster care and guardianship, in the legally established terms, return to carry out an activity on their own account within two years of the date of termination, they shall be entitled to a bonus under which your quota for common contingencies, including temporary incapacity, shall be fixed at the amount of 50 euros per month during the 12 months immediately following the date of their return to work, provided that they choose to contribute for the minimum base established in general in the special regime that corresponds by reason of the activity on their own account.

Those self-employed or self-employed workers who, fulfilling the above requirements, opt for a contribution base higher than the minimum indicated in the previous paragraph, may apply during the aforementioned period a bonus of 80 per cent on the quota for common contingencies, being the contribution to be subsidized the result of applying to the minimum contribution base established in general in the corresponding special regime the minimum rate of contribution in force at all times, including temporary disability.

Third additional provision. Coverage of temporary disability and occupational contingencies in the Social Security Scheme for Self-Employed or Self-Employed Workers

1. (…)

2. The Government shall determine those professional activities carried out by self-employed workers who present a higher risk of accidents, in which the coverage of contingencies of work accidents and occupational diseases of the Social Security will be mandatory. In such cases, the provisions of Article 26(3) shall apply.

Fourth additional provision. Cessation of activity benefit

The Government, provided that the principles of contributory, solidarity and financial sustainability are guaranteed and this responds to the needs and preferences of self-employed workers, will propose to the Cortes Generales the regulation of a specific system of protection for cessation of activity for them, depending on their personal characteristics or the nature of the activity carried out.

The articulation of the benefit for cessation of activity will be carried out in such a way that, in the cases in which it must be applied at ages close to the legal retirement, its application guarantees, in combination with the measures of anticipation of the retirement age in specific circumstances contemplated in the General Law of the Social Security , that the level of protection provided is the same, in equivalent cases of contribution career, contributory effort and causality, as that of employed workers, without this implying additional costs at the non-contributory level.

Public administrations may, for duly justified economic policy reasons, co-finance cessation of activity plans aimed at specific groups or economic sectors.

>> AS OF JANUARY 1, 2019 <<

Article 26. Protective action

1. The protective action of the Special Social Security Scheme for Self-Employed Or Self-Employed Workers, under the terms and in accordance with the legally provided conditions, shall include, in any case:

- (a) Health care in cases of maternity, common or occupational disease and accidents, whether or not they are at work.

- (b) Financial benefits in situations of temporary disability, risk during pregnancy, maternity, paternity, risk during breastfeeding, care of children with cancer or other serious illnesses,permanent disability, retirement, death and survival and dependent family members.

- (c) Coverage of accidents at work and occupational diseases.

For the purposes of this coverage, an accident at work of the economically dependent self-employed worker shall be understood as any bodily injury suffered on the occasion or as a result of the professional activity, and an accident at work is also considered to be that suffered by the worker when he or she goes to or return from the place where the activity is provided, or by cause or consequence thereof. Unless there is proof to the contrary, the accident shall be presumed to be unrelated to work when it occurred outside the course of the professional activity in question.

For the rest of the self-employed workers and for the purposes of the same coverage, an accident at work of the self-employed worker will be understood as occurring as a direct and immediate consequence of the work carried out on their own account and which determines their inclusion in the scope of application of this special regime. For the same purposes, an occupational disease shall be understood as one contracted as a result of self-employment, which is caused by the action of the elements and substances and in the activities specified in the list of occupational diseases with the relationships of the main activities capable of producing them, annexed to Royal Decree 1299/2006, of 10 November, which approves the table of occupational diseases in the Social Security system and establishes criteria for its notification and registration.

An accident at work shall also be understood as an accident suffered on going to or returning from the place where the economic or professional activity is being provided. For these purposes, the place of the benefit shall be understood as the establishment where the self-employed worker habitually carries out his activity provided that it does not coincide with his domicile and corresponds to the premises, warehouse or office declared as affected by the economic activity for tax purposes.

2. (…)

3. Repealed

Article 31. Social security contribution benefits applicable to self-employed workers

Social Security contributions of self-employed or self-employed workers who cause initial registration or who had not been in a situation of affiliation in the 2 years immediately preceding, counting from the date of effect of registration, in the Special Social Security Scheme for Self-Employed or Self-Employed Workers, shall be carried out as follows:

1. In the event that it is chosen to contribute for the corresponding minimum base, they may benefit from a reduction in the contribution for common contingencies during the first 12 months immediately following the date of effect of the registration, which it will consist of a single monthly fee of 60 euros, which will include both common contingencies and professional contingencies, leaving these workers exempt from contributions for cessation of activity and professional training. Of this fee of 60 euros, 51.50 euros correspond to common contingencies and 8.50 euros to professional contingencies.

2. Alternatively, those self-employed or self-employed workers who, fulfilling the requirements set out in the previous section, opt for a contribution base higher than the corresponding minimum, may be applied during the first 12 months immediately following the date of effect of the registration, a reduction of 80% on the contribution for common contingencies,being the quota to be reduced the resulting from applying to the minimum contribution base that corresponds to the minimum contribution rate in force for common contingencies.

After the initial period of 12 months provided for in the two previous sections, and regardless of the contribution base chosen, self-employed workers who benefit from the measure provided for in this article may apply the following reductions and bonuses on the contribution for common contingencies, being the quota to be reduced or subsidized the one resulting from applying to the minimum contribution base that corresponds to the contribution rate in force in each moment for common contingencies, for a maximum period of up to 12 months, until completing a maximum period of 24 months after the date of effects of the discharge, according to the following scale:

- (a) A reduction equivalent to 50 per cent of the quota during the 6 months following the initial period provided for in the first two subparagraphs of this subparagraph.

- (b) A reduction equivalent to 30 per cent of the quota for 3 months following the period referred to in point (a).

- (c) A bonus equivalent to 30 per cent of the quota for 3 months following the period referred to in point (b).

3. In the event that the self-employed or self-employed worker resides and develops his activity in a municipality in whose updated municipal register at the beginning of the activity there are less than 5,000 inhabitants, after the initial period of 12 months of application of the contribution benefits established in the previous sections,you will be entitled during the 12 months following these same incentives. In such cases, the reductions and bonuses for the 12 months following the initial period referred to in paragraph 2 shall not apply.

In order to benefit from these measures during the 12 months following the initial period, the self-employed or self-employed worker must:

- Be registered in a municipality of less than 5,000 inhabitants, according to the official data of the register in force at the time of registration in the Special Social Security Scheme for Self-Employed or Self-Employed Workers that causes the right to the incentive contemplated in this article.

- Be registered in the Census of Taxpayers of the State Agency of Tax Administration or the Foral Haciendas, corresponding the place of development of the declared activity to a municipality whose municipal register is less than 5,000 inhabitants.

- Maintain registration in the self-employed or self-employed activity in the aforementioned municipality in the two years following registration in the Special Social Security Scheme for Self-Employed or Self-Employed Workers that causes the right to the incentive contemplated in this article; as well as remain registered in the same municipality in the four years following said discharge.

The General Treasury of the Social Security will carry out the control of this reduction for which the National Institute of Statistics and the aforementioned Tax Administrations must make available to this Common Service the necessary means and information to verify compliance with the requirements required to benefit from this reduction.

In case of not fulfilling these requirements, the self-employed or self-employed worker must refund all the amounts left to pay by the application of the incentive, from the first day of the following month in which such non-compliance is accredited.

4. In the event that the self-employed workers are under 30 years of age, or under 35 years of age in the case of women, and cause initial registration or have not been in a situation of affiliation in the 2 years immediately preceding, counting from the date of effect of registration, in the Special Social Security Scheme for Self-Employed or Self-Employed Workers , may be applied, in addition to the contribution benefits provided for in the previous sections, an additional bonus equivalent to 30%, on the quota for common contingencies, in the 12 months following the end of the maximum period of enjoyment of the same, being the quota to be subsidized the result of applying to the minimum contribution base that corresponds the contribution rate for common contingencies in force at all times. In this case the maximum duration of the enjoyment of the benefits in the contribution it will be 36 months.

5. The period of withdrawal from the Special Social Security Scheme for Self-Employed or Self-Employed Workers, required in the previous sections to be entitled to the benefits in the contribution in them provided for in case of resuming a self-employed activity, will be 3 years when the self-employed workers had enjoyed said benefits in their previous period of registration in the aforementioned special regime.

6. In the event that the date of effect of the registrations referred to in paragraphs 1 to 4 does not coincide with the first day of the respective calendar month, the benefit corresponding to that month will be applied in proportion to the number of days of registration in it.

7. The provisions of the preceding paragraphs shall also apply, when they meet the requirements laid down therein, to self-employed workers who are included in the first contribution group of the Special Social Security Scheme for Sea Workers and to members of labour companies and to worker members of associated work cooperatives that are included in the Special Scheme for Workers’ Social Security. for Self-Employed or Self-Employed or in the Special Social Security Scheme for Sea Workers, within the first group of contributions.

8. The provisions of this Article shall apply even if the beneficiaries of this measure, once they have started their activity, employ employed persons.

9. The contribution bonuses provided for in this Article shall be financed from the corresponding budget line of the State Public Employment Service and the reductions in contributions shall be borne by the social security revenue budget and by the mutual societies collaborating with the social security,respectively.

10. The benefits in the contributions provided for in this article will consist of a bonus in the case of self-employed or self-employed workers registered in the National Youth Guarantee System who meet the requirements established in article 105 of Law 18/2014, of 15 October, on the approval of urgent measures for growth, competitiveness and efficiency, applying said bonus in the same terms as the incentives provided for in paragraphs 1 to 3 and also being entitled to the additional bonus referred to in paragraph 4.

11. After the maximum period of enjoyment of the contribution benefits contemplated in this article, the contribution will proceed for all the protected contingencies from the first day of the month following the one that the end occurs.

Article 31 bis. Benefits in social security contributions applicable to self-employed agricultural workers

The social security contributions of self-employed agricultural workers included in the Special System for Self-Employed Agricultural Workers who cause initial registration or who have not been registered in the 2 years immediately preceding, counting from the date of effect of registration in said Special System , shall be carried out as follows:

1. In the event that they choose to contribute for the corresponding minimum base, they may benefit from a reduction in the contribution for common contingencies during the first 12 months immediately following the date of effects of the registration, which will consist of a single monthly fee of 50 euros, corresponding to common contingencies, leaving these workers exempt from contributions for cessation of activity and professional training.

2. Alternatively, those self-employed agricultural workers who, fulfilling the requirements laid down in the previous section, opt for a contribution base higher than the minimum that corresponds, may apply during the first 12 months immediately following the date of effect of the registration, a reduction of 80 per cent on the contribution for common contingencies , being the quota to be reduced the result of applying to the minimum contribution base that corresponds to the minimum contribution rate in force for common contingencies.

After the initial period of 12 months provided for in the two previous sections, and regardless of the contribution base chosen, agricultural self-employed workers who benefit from the measure provided for in this article may apply the following reductions and bonuses on the quota for common contingencies, the contribution to be reduced or subsidized being the one resulting from applying to the minimum contribution base that corresponds to the current contribution rate at all times for common contingencies, for a maximum period of up to 12 months, until completing a maximum period of 24 months after the date of effects of discharge, according to the following scale:

- (a) A reduction equivalent to 50 per cent of the quota during the 6 months following the initial period provided for in the first two subparagraphs of this subparagraph.

- (b) A reduction equivalent to 30 per cent of the quota for 3 months following the period referred to in point (a).

- (c) A bonus equivalent to 30 per cent of the quota for 3 months following the period referred to in point (b).

3. In the event that the self-employed agricultural worker resides and develops his activity in a municipality in whose updated municipal register at the beginning of the activity there are less than 5,000 inhabitants, after the initial period of 12 months of application of the benefits in the contribution established in the previous sections, he will be entitled during the 12 months following these same incentives. In such cases, the reductions and bonuses for the 12 months following the initial period referred to in paragraph 2 shall not apply.

In order to benefit from these measures during the 12 months following the initial period, the self-employed agricultural worker must:

- Be registered in a municipality of less than 5,000 inhabitants, according to the official data of the register in force at the time of registration in the Special System for Self-Employed Agricultural Workers that causes the right to the incentive contemplated in this article.

- Be registered in the Census of Taxpayers of the State Agency of Tax Administration or the Foral Haciendas, corresponding the place of development of the declared activity to a municipality whose municipal register is less than 5,000 inhabitants.

- Maintain registration in the autonomous or self-employed activity in the aforementioned municipality in the two years following the registration in the Special System for Self-Employed Agricultural Workers that causes the right to the incentive contemplated in this article; as well as remain registered in the same municipality in the four years following said discharge.

The General Treasury of the Social Security will carry out the control of this reduction for which the National Institute of Statistics and the aforementioned Tax Administrations must make available to this Common Service the necessary means and information to verify compliance with the requirements required to benefit from this reduction.

In case of not fulfilling these requirements, the self-employed agricultural worker must refund all the amounts left to pay by the application of the incentive, from the first day of the following month in which such non-compliance is accredited.

4. In the event that the self-employed agricultural workers are under 30 years of age, or under 35 years of age in the case of women, and cause initial registration or have not been in a situation of registration in the 2 years immediately preceding, counting from the date of effect of registration, in the Special System for Self-Employed Agricultural Workers , may be applied, in addition to the benefits in the contribution provided for in the previous sections, an additional bonus equivalent to 30 percent, on the quota for common contingencies, in the 12 months following the end of the maximum period of enjoyment of the same, being the quota to be subsidized the result of applying to the minimum contribution base that corresponds to the contribution rate for common contingencies in force at all times. In this case the maximum duration of the enjoyment of the benefits in the contribution will be 36 months.

5. The period of withdrawal from the Special System for Self-Employed Agricultural Workers required in the previous sections to be entitled to the benefits in the contribution in them provided for in case of resuming a self-employed activity, will be 3 years when the self-employed workers had enjoyed these benefits in their previous period of registration in the aforementioned special regime.

6. In the event that the date of effect of the registrations referred to in paragraphs 1 to 4 does not coincide with the first day of the respective calendar month, the benefit corresponding to that month will be applied in proportion to the number of days of registration in it.

7. The provisions of this Article shall apply even if the beneficiaries of this measure, once they have started their activity, employ employed persons, within the limits laid down in Article 324 of the revised text of the General Social Security Law.

8. The contribution bonuses provided for in this article shall be financed from the corresponding budget line of the Public State Employment Service and the reductions in contributions shall be borne by the social security revenue budget and by the mutual societies collaborating with the Social Security, respectively.

9. The benefits in the contributions provided for in this article will consist of a bonus in the case of self-employed or self-employed workers registered in the National Youth Guarantee System who meet the requirements established in article 105 of Law 18/2014, of 15 October, on the approval of urgent measures for growth, competitiveness and efficiency, applying said bonus in the same terms as the incentives provided for in paragraphs 1 to 3 and also being entitled to the additional bonus referred to in paragraph 4.

10. After the maximum period of enjoyment of the contribution benefits contemplated in this article, the contribution will proceed for all the protected contingencies from the first day of the month following the one that the end occurs.

Article 32. Benefits in social security contributions for people with disabilities, initial or over,victims of gender violence and victims of terrorism who establish themselves as self-employed

Social security contributions for self-employed or self-employed workers with a degree of disability equal to or greater than 33 per cent, victims of gender violence and victims of terrorism who cause initial discharge or who had not been in a situation of registration in the 2 years immediately preceding, counting from the date of effect of registration, in the Special Social Security Scheme for Self-Employed or Self-Employed Workers , shall be carried out as follows:

1. In the event that they choose to contribute for the corresponding minimum base, they may benefit from a reduction on the contribution for common contingencies during the first 12 months immediately following the date of effects of the registration, which will consist of a single monthly fee of 60 euros, which will include both common contingencies and professional contingencies , leaving these workers exempt from contributions for cessation of activity and vocational training. Of this fee of 60 euros, 51.50 euros correspond to common contingencies and 8.50 euros to professional contingencies.

2. Alternatively, those self-employed or self-employed workers who, fulfilling the requirements set out in the previous section, opt for a contribution base higher than the minimum that corresponds, may apply during the first 12 months immediately following the date of effect of the registration, a reduction of 80 per cent on the quota for common contingencies , being the quota to be reduced the result of applying to the minimum contribution base that corresponds to the contribution rate for common contingencies in force at all times.

After the initial period of 12 months provided for in the two previous sections, and regardless of the contribution base chosen, self-employed workers who benefit from the measure provided for in this article may apply a bonus on the quota for common contingencies, being the contribution to be subsidized the result of applying to the minimum contribution base that corresponds to 50 per cent of the result of applying to the base minimum contribution that corresponds to the rate of contribution for common contingencies in force at all times, for a maximum period of up to 48 months, until completing a maximum period of 5 years after the date of effect of registration.

3. In the event that the self-employed or self-employed worker resides and develops his activity in a municipality in whose updated municipal register at the beginning of the activity there are less than 5,000 inhabitants, after the initial period of 12 months of application of the benefits in the contribution established in the previous sections, he will be entitled during the 12 months following these same incentives. In these cases, the application of the 50 per cent bonus, provided for in the previous section, will be applied after the initial 24 months have elapsed, for a maximum period of up to 36 months, until completing a maximum period of 5 years from the date of effect of registration.

In order to benefit from these measures during the 12 months following the initial period, the self-employed or self-employed worker must:

- Be registered in a municipality of less than 5,000 inhabitants, according to the official data of the register in force at the time of registration in the Special Social Security Scheme for Self-Employed or Self-Employed Workers that causes the right to the incentive contemplated in this article.

- Be registered in the Census of Taxpayers of the State Agency of Tax Administration or the Foral Haciendas, corresponding the place of development of the declared activity to a municipality whose municipal register is less than 5,000 inhabitants.

- Maintain registration in the self-employed or self-employed activity in the aforementioned municipality in the two years following registration in the Special Social Security Scheme for Self-Employed or Self-Employed Workers that causes the right to the incentive contemplated in this article; as well as remain registered in the same municipality in the four years following said discharge.

The General Treasury of the Social Security will carry out the control of this reduction for which the National Institute of Statistics and the aforementioned Tax Administrations must make available to this Common Service the necessary means and information to verify compliance with the requirements required to benefit from this reduction.

In case of not fulfilling these requirements, the self-employed or self-employed worker must refund all the amounts left to pay by the application of the incentive, from the first day of the following month in which such non-compliance is accredited.

4. The period of withdrawal from the Special Social Security Scheme for Self-Employed or Self-Employed Workers, required in the previous sections to be entitled to the benefits in the contribution in them provided for in case of resuming a self-employed activity, will be 3 years when the self-employed workers had enjoyed said benefits in their previous period of registration in the aforementioned special regime.

5. In the event that the date of effect of the registrations referred to in paragraphs 1 to 3 does not coincide with the first day of the respective calendar month, the benefit corresponding to that month will be applied in proportion to the number of days of registration in it.

6. The provisions of the preceding paragraphs shall also apply, when they meet the requirements laid down therein, to self-employed workers who are included in the first contribution group of the Special Social Security Scheme for Sea Workers and to members of labour companies and to worker members of associated work cooperatives that are included in the Special Scheme for Workers’ Social Security. for Self-Employed or Self-Employed or in the Special Social Security Scheme for Sea Workers, within the first group of contributions.

7. The provisions of this Article shall apply even if the beneficiaries of this measure, once they have started their activity, employ employed persons.

8. The contribution bonuses provided for in this article shall be financed from the corresponding budget line of the Public State Employment Service and the reductions in contributions shall be borne by the social security revenue budget and by the mutual societies collaborating with the Social Security, respectively.

9. After the maximum period of enjoyment of the contribution benefits contemplated in this article, the contribution will proceed for all the protected contingencies from the first day of the month following the one that the end occurs.

10. The provisions of this article shall also apply, at the option of the interested parties, in the cases of self-employed workers who, while registered in this special scheme, are disabled to a degree equal to or greater than 33 per cent.

In that case, the measures provided for in this Article shall be applied from the first day of the month following that in which the choice is made.

Article 32 bis. Benefits in social security contributions for people with disabilities, initial or oversamore, victims of gender violence and victims of terrorism who establish themselves as self-employed workers included in the Special System for Self-Employed Agricultural Workers

The social security contributions of self-employed agricultural workers included in the Special System for Self-Employed Agricultural Workers with a degree of disability equal to or greater than 33 per cent, victims of gender violence and victims of terrorism, who cause initial discharge or who had not been in a situation of registration in the 2 years immediately preceding , from the date of effect of registration in said Special System, shall be carried out as follows:

1. In the event that they choose to contribute for the corresponding minimum base, they may benefit from a reduction in the contribution for common contingencies during the first 12 months immediately following the date of effects of the registration, which will consist of a single monthly fee of 50 euros, corresponding to common contingencies, leaving these workers exempt from contributions for cessation of activity and professional training.

2. Alternatively, those self-employed agricultural workers who, fulfilling the requirements laid down in the previous section, opt for a contribution base higher than the minimum that corresponds, may apply during the first 12 months immediately following the date of effect of the registration, a reduction of 80 per cent on the contribution for common contingencies , being the quota to be reduced the result of applying to the minimum contribution base that corresponds to the minimum contribution rate in force for common contingencies.

After the initial period of 12 months provided for in the two previous sections, and regardless of the contribution base chosen, self-employed workers who benefit from the measure provided for in this article may apply a bonus on the quota for common contingencies, being the contribution to be subsidized the result of applying to the minimum contribution base that corresponds to 50 per cent of the result of applying to the base minimum contribution that corresponds to the rate of contribution for common contingencies in force at all times, for a maximum period of up to 48 months, until completing a maximum period of 5 years after the date of effect of registration.

3. In the event that the self-employed agricultural worker resides and develops his activity in a municipality in whose municipal register updated at the beginning of the activity there are less than 5,000 inhabitants, after the initial period of 12 months of application of the benefits in the contribution established in the previous sections, he will be entitled during the 12 months following these same incentives. In these cases, the application of the bonus for 50 percent, provided for in the previous section, will be applied after the initial 24 months have elapsed, for a maximum period of up to 36 months, until completing a maximum period of 5 years from the date of effect of registration.

In order to benefit from these measures during the 12 months following the initial period, the self-employed agricultural worker must:

- Be registered in a municipality of less than 5,000 inhabitants, according to the official data of the register in force at the time of registration in the Special System for Self-Employed Agricultural Workers that causes the right to the incentive contemplated in this article.

- Be registered in the Census of Taxpayers of the State Agency of Tax Administration or the Foral Haciendas, corresponding the place of development of the declared activity to a municipality whose municipal register is less than 5,000 inhabitants.

- Maintain registration in the autonomous or self-employed activity in the aforementioned municipality in the two years following the registration in the Special System for Self-Employed Agricultural Workers that causes the right to the incentive contemplated in this article; as well as remain registered in the same municipality in the four years following said discharge.

The General Treasury of the Social Security will carry out the control of this reduction for which the National Institute of Statistics and the aforementioned Tax Administrations must make available to this Common Service the necessary means and information to verify compliance with the requirements required to benefit from this reduction.

In case of not fulfilling these requirements, the self-employed agricultural worker must refund all the amounts left to pay by the application of the incentive, from the first day of the following month in which such non-compliance is accredited.

4. The period of withdrawal from the Special System for Self-Employed Agricultural Workers required in the previous sections to be entitled to the benefits in the contribution in them provided for in case of resuming a self-employed activity, will be 3 years when the self-employed agricultural workers had enjoyed said benefits in their previous period of registration in the aforementioned special system.

5. In the event that the date of effect of the registrations referred to in paragraphs 1 to 4 does not coincide with the first day of the respective calendar month, the benefit corresponding to that month will be applied in proportion to the number of days of registration in it.

6. The provisions of this Article shall apply even if the beneficiaries of this measure, once they have started their activity, employ employed persons, within the limits laid down in Article 324 of the revised text of the General Social Security Law.

7. The contribution bonuses provided for in this article shall be financed from the corresponding budget line of the State Public Employment Service and the reductions in contributions shall be borne by the social security revenue budget and by the mutual societies collaborating with the social security, respectively.

8. After the maximum period of enjoyment of the contribution benefits contemplated in this article, the contribution will proceed for all the protected contingencies from the first day of the month following the one that the end occurs.

9. The provisions of this article shall also apply, at the option of the interested parties, in the cases of self-employed workers who, being registered in this special regime, have a disability to a degree equal to or greater than 33 per cent.

In that case, the measures provided for in this Article shall be applied from the first day of the month following that in which the choice is made.

Article 38 bis. Bonuses for self-employed women who return to work in certain cases

Workers included in the Special Social Security Scheme for Self-Employed Or Self-Employed Workers or as self-employed workers in the first contribution group of the Special Social Security Scheme for Sea Workers, who, having ceased their activity due to maternity, adoption, keep for the purpose of adoption , foster care and guardianship, in the legally established terms, return to carry out an activity on their own account within two years immediately following the effective date of the cessation, they will be entitled to a bonus by virtue of which their quota for common contingencies and professional contingencies, will be fixed in the amount of 60 euros per month during the 12 months immediately following the date of their return to work , provided that they choose to contribute to the minimum base established in general in the special regime that corresponds to the activity on their own account.

Those self-employed or self-employed workers who, fulfilling the above requirements, opt for a contribution base higher than the minimum indicated in the previous paragraph, may apply during the aforementioned period a bonus of 80 per cent on the contribution for common contingencies, the contribution to be reduced being the one resulting from applying to the minimum contribution base that corresponds to the contribution rate for common contingencies in force at all times.

Third additional provision. Coverage of temporary disability and occupational contingencies in the Social Security Scheme for Self-Employed or Self-Employed Workers

1. (…)

2. Deleted

Fourth additional provision. Cessation of activity benefit

The Government, provided that the principles of contributory, solidarity and financial sustainability are guaranteed and this responds to the needs and preferences of self-employed workers, will propose to the Cortes Generales the regulation of a specific system of protection for cessation of activity for them, depending on their personal characteristics or the nature of the activity carried out.

All other text, DELETED

Amendments to the General Social Security Law

>> UNTIL DECEMBER 31, 2018 <<

Article 83. Option scheme for associated employers and self-employed persons

1. Employers and self-employed workers, at the time of fulfilling before the General Treasury of the Social Security their respective obligations of registration of company, affiliation and registration, will record the managing entity or the mutual collaborator with the Social Security for which they have chosen to protect occupational contingencies, the economic benefit for temporary disability derived from common contingencies and the protection for cessation of activity , in accordance with the rules governing the Social Security scheme in which they are encudren, and will communicate to it their subsequent modifications. The General Treasury of the Social Security shall be responsible for the recognition of such declarations and their legal effects, in the terms established by regulation and without prejudice to the particularities provided in the following sections if a mutual collaborator with the Social Security is chosen.

The option in favor of a mutual collaborator with the Social Security will be made in the form and will have the scope that are established below:

- a) Employers who opt for a mutual society for the protection of accidents at work and occupational diseases of the Social Security must formalize with it the association agreement and protect in the same entity all workers corresponding to workplaces located in the same province, these being understood as the definition contained in the revised text of the Workers’ Statute Law.

Likewise, the associated employers may choose to have the same mutual society manage the financial benefit for temporary disability derived from common contingencies with respect to workers protected against occupational contingencies.

The association agreement is the instrument by which the association is formalized to the mutual society and will have a period of validity of one year, which may be extended for periods of equal duration. Regulations will regulate the procedure for formalizing the agreement, its content and effects.

- b) Workers falling within the scope of application of the Special Social Security Scheme for Self-Employed or Self-Employed Workers whose protective action includes, voluntarily or compulsorily, the economic benefit for temporary disability, must formalize it with a mutual collaborator with the Social Security, as well as those who change entity.

Self-employed workers who join a mutual society in accordance with the provisions of the previous paragraph and who also cover occupational contingencies, voluntarily or compulsorily, must formalize their protection with the same mutual society. Likewise, those that cover exclusively professional contingencies must adhere.

Self-employed workers included in the Special Social Security Scheme for Sea Workers may choose to protect occupational contingencies with the managing body or with a mutual society collaborating with the Social Security. Workers included in the third group of contributions must formalize the protection of common contingencies with the managing body of the Social Security.

The protection will be formalized by means of a document of adhesion, by which the self-employed worker is incorporated into the management field of the mutual society externally to the associative base of the same and without acquiring the rights and obligations derived from the association. The period of validity of the accession will be one year, and may be extended for periods of equal duration. The procedure for formalising the accession document, its content and effects, shall be regulated by regulation.

- c) The workers included in the Special Social Security Scheme for Self-Employed or Self-Employed Workers must formalize the management for cessation of activity with the mutual society to which they are attached by subscribing to the annex corresponding to the accession document, in the terms established by the regulatory rules that regulate the collaboration. For their part, the self-employed workers included in the Special Social Security Scheme for Sea Workers will formalize the protection with the managing body or with the mutual society with whom they protect professional contingencies.

Article 102. Collaboration of companies

1. Undertakings, individually considered and in relation to their own staff, may collaborate in the management of social security exclusively in one or more of the following ways:

- (a) Assuming directly the payment, at their expense, of the benefits for temporary disability resulting from an accident at work and occupational disease and the benefits of health care and occupational recovery, including the corresponding corresponding allowance during the aforementioned situation.

- (b) Assuming directly the payment, at their expense, of the economic benefits for temporary disability derived from common illness or non-work-related accident, under the conditions established by the Ministry of Employment and Social Security.

Companies that take part in this form of collaboration will have the right to reduce the social security contribution by applying the coefficient set for this purpose by the Ministry of Employment and Social Security.

- c) Paying its workers, at the expense of the managing body or mutual society obliged, the economic benefits for temporary disability, as well as the others that may be determined by regulation.

2. (…)

3. (…)

4. (…)

5. In the regulation of the modalities of collaboration established in the letters a) and (b) paragraphs 1 and 4 shall harmonise the special interest in improving benefits and means of assistance with the requirements of national solidarity.

Article 146. Contributions for accidents at work and occupational diseases

1. (…)

2. (…)

3. (…)

4. New section in 2019

Article 151. Quotation on short-term contracts

In temporary contracts whose effective duration is less than seven days,the employer’s contribution to the Social Security for common contingencies will be increased by 36%. This increase will not apply to temporary contracts or to workers included in the Special System for Employed Agricultural Workers.

Article 170. Powers over temporary disability processes

1. Until the completion of the three hundred and sixty-five-day period of the temporary disability proceedings, the National Social Security Institute shall exercise, through the medical inspectors attached to that entity, the same powers as the Social Security Health Services Inspectorate or equivalent body of the respective public health service. , to issue a medical discharge for all purposes.

(…)

When the discharge has been issued by the National Social Security Institute, this will be the only competent one, through its own medical inspectors, to issue a new medical leave produced by the same or similar pathology in the one hundred and eighty days following the aforementioned medical discharge.

Article 196. Financial benefits

1. (…)

2. The financial benefit corresponding to total permanent disability shall consist of a lifetime pension, which may exceptionally be replaced by a flat-rate allowance where the beneficiary is under sixty years of age.

Those declared to be affected by total permanent disability will receive the pension provided for in the previous paragraph, increased by the percentage determined by regulation, when due to their age, lack of general or specialized preparation and social and work circumstances of the place of residence, the difficulty of obtaining employment in an activity other than the usual previous one is presumed.

The amount of the total permanent disability pension derived from common illness may not be less than 55% of the minimum contribution base for people over eighteen years of age, in annual terms, in force at all times.

Article 249. Protective action

1. The protective action of the Social Security of the worker hired for training and apprenticeship shall include all contingencies, protectable situations and benefits of that, including unemployment.

With regard to unemployment protection, the provisions of Title III shall apply with the specialities provided for in Article 290.

2. In the case of contracts for training and apprenticeship signed with student workers in the programmes of workshop schools, trades houses and employment workshops, the protective action of the Social Security will include the same contingencies, protectable situations and benefits as for the rest of the workers hired under this modality, with the exception of unemployment.

Article 249 bis. Calculation of contribution periods in short-term contracts

New precept in 2019

Article 308. quote in the case of coverage of occupational contingencies and in the case of coverage of cessation of activity

1. Where workers included in this special scheme are covered by contingencies of accidents at work and occupational diseases, the provisions of the first paragraph of Article 19.3 shall apply on the basis of contributions chosen by the person concerned.

2. The cover for the cessation of activity shall determine the obligation to make the corresponding contributions, in accordance with the terms laid down in Article 344.

Self-employed workers covered by the protection system for cessation of activity will have a reduction of 0.5 percentage points in the contribution for temporary disability coverage, derived from common contingencies.

Article 311. Contributions with sixty-five or more years of age

1. Workers included in this special scheme shall be exempt from social security contributions, except, where appropriate, for temporary disability and occupational contingencies, provided that they are in any of these cases:

- (a) Sixty-five years of age and thirty-eight years and six months of contributions.

- (b) Sixty-seven years of age and thirty-seven years of contributions.

In all the aforementioned cases, for the purposes of calculating years of contributions, the proportional parts of extraordinary payments will not be taken into account.

Article 313. Contribution in cases of pluriactivity

1. Self-employed workers who, by reason of a job as an employed person carried out simultaneously, contribute for common contingencies under a multi-activity scheme, taking into account both the contributions made in this special scheme and the employer’s contributions and those corresponding to the worker in the Social Security scheme corresponding to his activity as an employed person , will be entitled to the refund of 50 per cent of the excess in which their contributions exceed the amount established for this purpose by the General State Budget Law for each year, with a ceiling of 50 per cent of the contributions paid into this special regime, due to their contributions for the common contingencies of mandatory coverage.

In such cases, the General Treasury of the Social Security will proceed to pay the refund that in each case corresponds before May 1 of the following year, except when there are specialties in the contribution that prevent it from being made within that period or it is necessary to provide data by the interested party, in which case the refund will be made after that date.

Article 316. Coverage of professional contingencies

1. Workers included in this special scheme may voluntarily improve the scope of their protective action by incorporating that corresponding to contingencies of accidents at work and occupational diseases, provided that they are covered under the same special scheme the financial benefit for temporary disability.

The coverage of professional contingencies will be carried out with the same entity, manager or collaborator, with which the coverage of temporary disability has been formalized and will determine the obligation to make the corresponding contributions, in the terms provided for in article 308.

For the contingencies indicated, the benefits that, for the same, are granted to the workers included in the General Social Security Scheme will be recognized, under the conditions that are established by regulation.

Article 317. Protective action for economically dependent self-employed workers

In accordance with the provisions of article 26.3 of Law 20/2007, of July 11, economically dependent self-employed workers must incorporate, within the scope of the social security protection action, the coverage of temporary disability and accidents at work and occupational diseases.

For the purposes of this coverage, an accident at work shall be understood as any bodily injury suffered by the economically dependent self-employed worker who suffers on the occasion or as a result of the professional activity, and an accident at work is also considered to be that suffered by the worker when he or she goes to or return from the place where the activity is provided, or by cause or consequence thereof. Unless there is proof to the contrary, the accident shall be presumed to be unrelated to work when it occurred outside the course of the professional activity in question.

Article 321. Birth and amount of temporary disability benefit

1. For workers included in this special scheme, the birth of the economic benefit for temporary disability to which they may be entitled shall occur, under the terms and conditions established by regulation, from the fourth day of the leave in the corresponding activity, except in cases where the interested party has opted for the coverage of occupational contingencies, or has them covered in a mandatory way, and the benefit originated as a result of an accident at work or occupational disease, in which case the benefit will arise from the day following that of the leave.

2. The percentages applicable to the regulatory base for the determination of the amount of the economic benefit for temporary disability derived from common contingencies will be those in force in the General Regime with respect to the processes derived from the indicated contingencies.

Article 325. Specialties in contributions

The incorporation into the Special System for Self-Employed Agricultural Workers provided for in the previous article will determine the application of the following rules regarding social security contributions:

- a) With regard to contingencies of compulsory coverage, if the worker opts as a contribution base for a base of amount up to 120 per cent of the minimum base that corresponds to this special scheme,the applicable contribution rate will be 18.75%.

If, on the other hand, the worker opts for a contribution base higher than that indicated in the previous paragraph, on the amount exceeding the latter, the contribution rate in force at any time in this special scheme for contingencies of compulsory coveragewill be applied.

- b) With regard to contingencies of voluntary coverage, the quota will be determined by applying, on the full amount of the contribution base, the rates in force in this special regime for such contingencies.

Article 327. Purpose and scope

1. The specific system of protection for cessation of activity is part of the protective action of the Social Security system, it is of a voluntary nature and its purpose is to exempt self-employed workers, members of the Social Security and registered in the Special Scheme for Self-Employed Or Self-Employed Workers or in the Special Scheme for Sea Workers, the benefits and measures established in this Law in the event of total cessation of activity that led to the registration in the special scheme. , notwithstanding the power and desire to pursue an economic or professional activity for profit.

The cessation of activity may be permanent or temporary. The temporary cessation entails the interruption of all the activities that originated the registration in the special regime in which the self-employed worker is included, in the cases regulated in article 331.

Article 329. Protective action

1. The system of protection for cessation of activity includes the following benefits:

- a) The economic benefit for total cessation, temporary or definitive, of the activity.