The Tax Agency explains the new system of keeping the record books of the Value Added Tax through the Electronic Office of the AEAT, through the quasi-immediate supply of the billing records.

Because the current technological situation allows its implementation at this time, to improve tax control and taxpayer assistance.

1. ¿COrmor sand gandStiornto toCtAULmentand the VAT?

VAT is managed on the basis of the information provided by taxable persons and the rest of the information obtained by the AEAT.

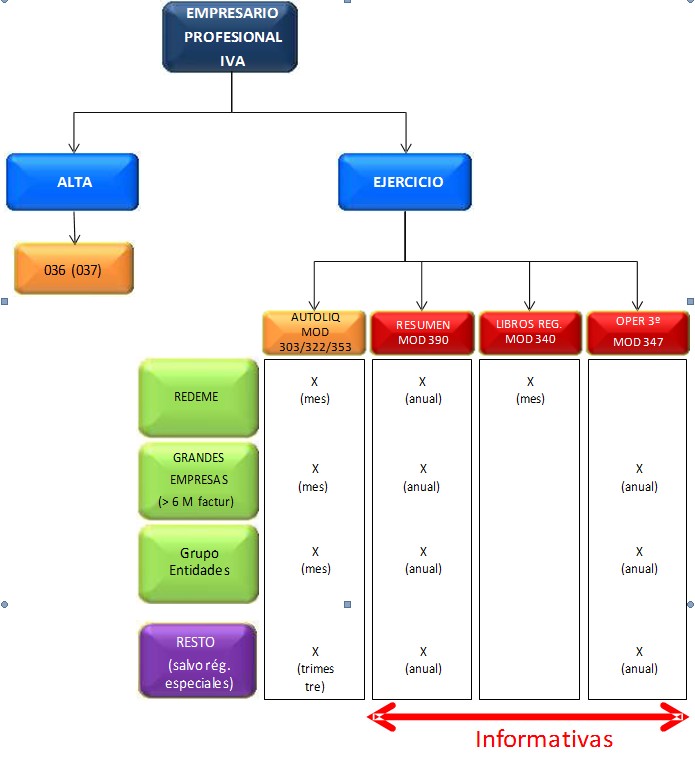

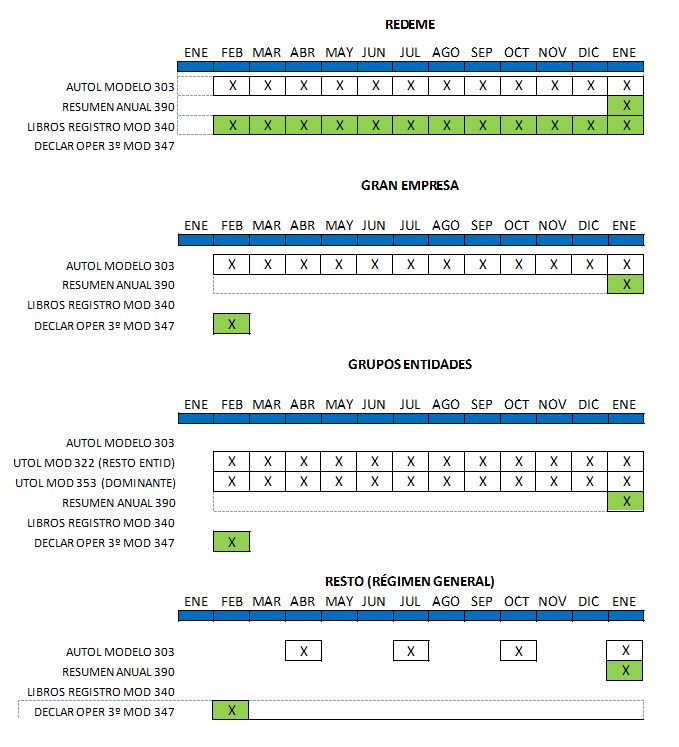

With regard to the main information and self-assessment obligations in vat (exceptions to the special regimes, except for the Group of Entities due to their impact on the SII as we will see), the following table shows those related to the registration of the taxpayer and those corresponding to the exercise of his business or professional activity.

Apart from the above, taxable persons are obliged to carry the following

Books VAT Records:

Record Book of Invoices issued

Record Book of Invoices received

Record Book of Intra-Community Operations

Investment Goods Registration Book

2. QHat ands the Sorministrho Inmandditotor de Inforrmtocion (IBS)?

This is a change from the current VAT management system that has been in operation for 30 years, as it moves to a new system of keeping the Value Added Tax registration books through the Electronic Office of the AEAT, through the quasi-immediate supply of billing records.

In this way, the new SII allows to bring the moment of registration or accounting of invoices closer to that of the effective realization of the economic operation that underlies them.

3. Why is the Immediate Provision of Information (SII) implemented?

Because the current technological situation allows its implementation at this time, to improve tax control and taxpayer assistance.

4. Does the SII affect all TAXable persons?

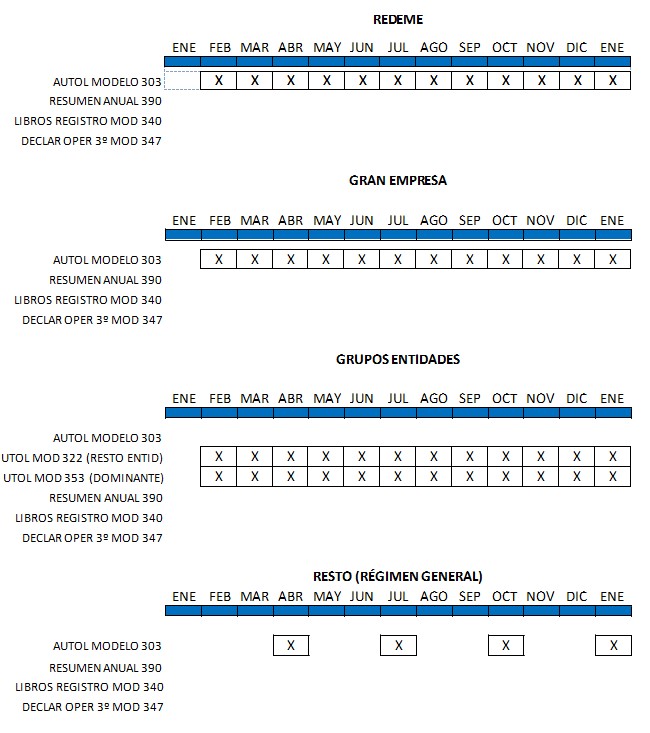

The new SII will be applicable on a mandatory basis to taxable persons who currently have an obligation to self-assessment VAT on a monthly basis:

Registered in the REDEME (Monthly VAT Refund Register)

Large Companies (turnover of more than €6 million)

VAT Groups

The new SII will also be applicable to taxable persons who, voluntarily, decide to take advantage of it (opting in form 036 in the month of November prior to the year in which it will take effect).

5. Basic lines of operation of the SII

Record book of invoices issued.

Record book of invoices received.

Record book of investment goods.

Record book of certain intra-Community transactions.

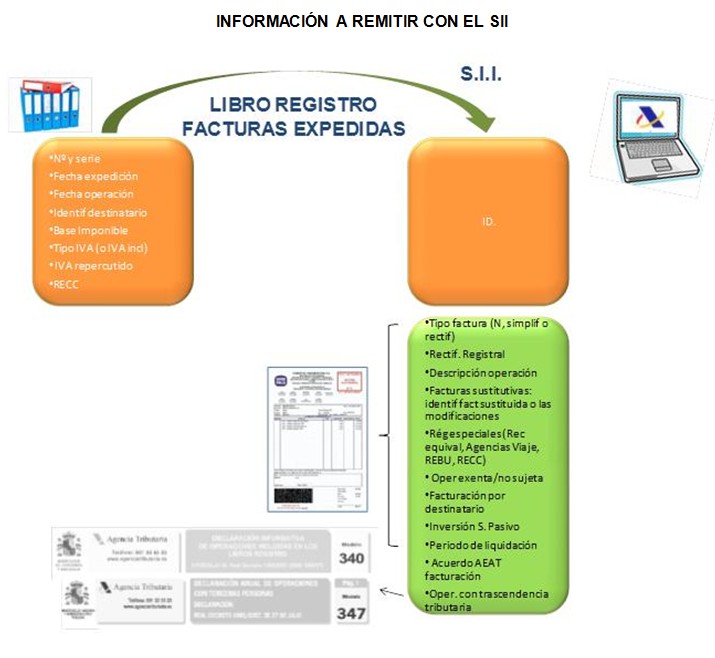

To do this, they must send the AEAT the details about their billing, with whose information the different Registry Books will be configured almost in real time.

The sending of this information will be done electronically, specifically through Web Services based on the exchange of XML messages.

The structure of this shipment will have a common header with the information of the owner of each record book, as well as the information of the year and period in which these operations are recorded. This header will be accompanied by a block with the contents of the invoices.

The provision of this information will be carried out in accordance with the registration fields approved by the Minister of Finance and Public Administrations through the corresponding Ministerial Order.

6. Do I have to send invoices to the AEAT?

No. This is usually one of the issues that generates more confusion in those who analyze for the first time the new IBS.

What needs to be submitted are the fields of the billing records that are

specify in the corresponding Ministerial Order, with respect to the information referred to in the Draft Royal Decree that is currently being processed.

7. When do I have to send the billing records to the AEAT?

A) Invoices issued

Within four calendar days of the issue of the invoice, except in the case of invoices issued by the addressee or by a third party, in which case this period shall be eight calendar days. In both cases, the supply must be made before the 16th day of the month following that in which the accrual of the Tax corresponding to the operation to be registered had occurred.

B) Factorreci bidas

Within a period of four calendar days from the date on which the accounting record of the invoice takes place and, in any case, before the 16th day of the month following the settlement period in which the corresponding operations have been included.

In the case of import operations, the four calendar days must be computed from the date of the accounting record of the document containing the quota settled by customs and in any case before the 16th day of the month following the end of the period to which the declaration in which they have been included refers.

C) Orperationands intrAcorMunitArias

Within a period of four calendar days, from the moment of commencement of dispatch or transport, or where appropriate, from the moment of receipt of the goods to which they refer.

D) InFormation sorBre bienes de inversion

Within the deadline for submission of the last settlement period of the year (until January 30).

It should be borne in mind that in the calculation of the period of four or eight calendar days referred to in the previous sections, Saturdays, Sundays and declared national holidays will be excluded.

8. Do I have to send the same information that is currently included in the Books VAT Records?

No, it is about sending certain information that is currently in two different places (VAT Record Books and Invoices) to the Electronic Office of the AEAT, disregarding the taxpayer of the keeping of the current VAT Registration Books, as can be seen in the following scheme. Likewise, certain information with tax significance that until now was included in forms 340 and 347 (articles 33 to 36 of the RGAT) will be provided:

The information related to the Register Book of Issued Invoices that must be communicated to the AEAT through the new SII (contained both in the current Registry Books and in the fields of the invoices themselves) is shown below:

For its part, the information related to the Register Book of Received Invoices that must be communicated to the AEAT through the new SII (contained both in the current Registry Books and in the fields of the invoices themselves) is as follows:

9. What are the advantages for the taxpayer of the new SII?

The new SII entails the following advantages for the taxpayer:

- Reduction of formal obligations, eliminating the obligation to present forms 347, 340 and 390, as well as the preparation of VAT Record Books. They must only submit the corresponding self-assessments of the tax:

- Obtaining “Tax Data” since in the Electronic Office you will have a Book Registry “declared” and another “contrasted” with the contrast information from third parties that belong to the collective of this system or the database of the AEAT.

- These tax data will be a useful tool to assist in the preparation of the return, reducing errors and allowing simplification and greater legal certainty.

- Extension by ten days of the deadline for submission of periodic self-assessments.

- Reduction of the deadlines for making the returns, by having the AEAT of the information in almost real time and more information about the operations.

- Reduction of verification periods, for the same reasons as above.

- Reduction of information requirements, since many of the current requirements are intended to request invoices or data contained therein to verify certain operations.

10. When will the new SII apply?

From the 1 de January de 2017 starttorá Lto fAse ObligtoTorAI of application of this system both for those taxpayers included in a mandatory way, and for those who opt voluntarily.

11. What regulatory changes need to be made?

Law 28/2014, of 27 November, amending Law 37/1992, of 28 December, on Value Added Tax, Law 20/1991, of 7 June, amending the fiscal aspects of the Economic and Fiscal Regime of the Canary Islands, Law 38/1992, of 28 December, on Special Taxes, and Law 16/2013, of 29 October, which establishes certain measures in the field of environmental taxation and adopts other tax and financial measures, established the possibility of regulating the obligation to keep the Value Added Tax Registration Books through this system.

Likewise, Law 34/2015 of September 21, partially amending Law 58/2003, of December 17, General Tax, establishes a specific infraction to be able to sanction the delay in the keeping of the Record Books through the Electronic Office of the AEAT in the terms established by regulation.

Regarding the regulatory development foreseen in the Draft Royal Decree for the modernization, improvement and promotion of the use of electronic means in the management of Value Added Tax, which modifies the Value Added Tax Regulation, approved by Royal Decree 1624/1992, of December 29, the General Regulation of the actions and procedures of tax management and inspection and development of the common rules of the procedures for the application of taxes, approved by Royal Decree 1065/2007, of 27 July, and the Regulation regulating invoicing obligations, approved by Royal Decree 1619/2012, of 30 November, is in its last phase of processing, with its approval and subsequent publication expected in the last quarter of 2015.

Finally, the fields of registration of the information to be provided will be approved by the Minister of Finance and Public Administrations through the corresponding Ministerial Order.

Source: Tax Agency