The Tax on Economic Activities (IAE) is a tax managed by the City Councils, used to tax the activities of all people in the Spanish tax system, both physical and legal. In addition, its balance depends exclusively on the activity of the person concerned.

What is the Economic Activities Tax or IAE?

The IAE or Tax on Economic Activities is the one that taxes the business, professional or artistic activity of both the self-employed and companies.

Depending on the type of activity carried out, the tax can be state, provincial or local.

IAE for freelancers

In the case of the self-employed, it should be noted that the individual self-employed would be exempt from the taxation of the IAE.

However, in case you have formed civil societies or communities of property, these will be subject.

If you want to check if your activity should be subject to the tax, you should look in the listings of epigraphs.

IAE for Business

In the event that you start the constitution of a company,you will also be subject to the payment of this tax.

In addition, as in the previous case, the heading of the activity to be carried out should be consulted.

Business activities are exhaustively defined by the Act. Thus, we can say that these are those exercised by an independent livestock, industries, services, commercial and mining activities, as well as the professionals carried out by legal entities or entities of which they are included in article 35.4 of the General Tax Law (LGT).

That is, according to the Law, livestock farmers who are dependent, forestry, agricultural and fishing are excluded from the consideration of business activities.

The taxable event of the IAE tax is formed by the production of artistic, business or professional activities,even though there is no specific physical place where it is carried out.

In the case of companies, there is also an exemption from the IAE for the first two years,and then it will be taxed from the exceeding of the limits.

Who is obliged to pay the Economic Activities Tax?

This tax is mandatory for:

- Autonomous.

- Communities of goods.

- Civil Societies.

- Legal persons (companies).

- Recumbent inheritances.

Who is exempt from paying the IAE?

The Tax on Economic Activities is of a general nature. However, the Act provides for the following exceptions:

- Individuals will not have to face this tax.

- The State, the Autonomous Communities, local authorities, autonomous State bodies, public research bodies and entities governed by public law.

- Freelancers and companies during the first 2 years of activity.

- Civil and commercial companies that have a net turnover of less than 1,000,000 euros.

- Associations and foundations of the physically, mentally and sensory disabled,as well as non-profit organizations, under certain conditions.

- Taxpayers for Non-Resident Income Tax. Only in cases where they carry out their activity in Spain with a permanent establishment, and provided that they have a net turnover of less than 1,000,000 euros.

- The managing entities of the Social Security and the social security mutual societies regulated in Law 30/1995, of November 8, on the organization and supervision of private insurance.

- Spanish Red Cross.

- Taxable persons to whom the exemption under international treaties or conventions applies.

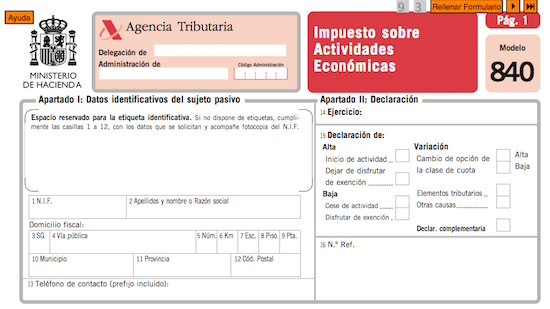

Models to be presented in the IAE declaration

Those obliged to submit the declaration of the Tax on Economic Activities must register through form 840.

Likewise, they must also present the form 848 for informing the Tax Agency of the net amount of their turnover, unless they present Corporation Tax, Non-Resident Income Tax, or form 184 based on the Informative Declaration of entities under the income attribution regime.

Where should you register with the IAE?

The registration in the IAE must be done in the Administrations of the Treasury that have delegated census management for the quotas of the municipalities.

Another place where you can register in the IAE is on the Net, that is, online by going to the Electronic Office of the Tax Agency.

IAE Fees

Its price is not fixed. In fact, the IAE rates will vary depending on the activity carried out,as well as the municipality in which it is carried out or the number of workers hired, since the calculation is different according to these factors.

Finally, the tax must be paid in each of the municipalities in which you are carrying out the specific activity.

The management of the tax is carried out from the annual registration that is generated for each municipality. You will be obliged to present the declaration that you have already been registered in IAE and inform about the changes in your physical, legal or economic order that have occurred when you are going to tax your activity.

The groups of business, professional and artistic activities of this tax will subsequently be divided into sections, headings, groups, groups, etc.

IAE fees comprise an orderly ratio based on description, quotas or content.

The IAE is approved by Legislative RD 1175/1990, of September 28 and the activities are described in its annex 1.

Given the obligatory nature of the presentation and payment of this tax for freelancers and companies, in AYCE LABORYTAX you will have

advisors specialized in the Tax on Economic Activities

who will know how to guide you and solve your doubts.