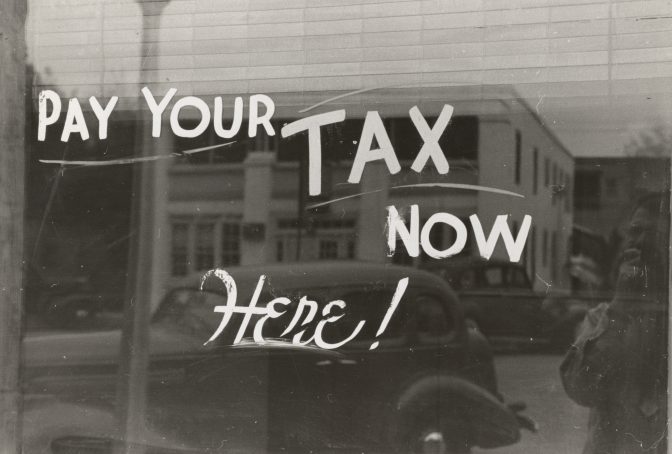

On October 21, the deadline for submitting VAT, withholdings on account of Income, and the fractional payment of Companies and Income corresponding to the third quarter of 2019 ends. Remember that to be able to direct debit the payment of the settlements, the term ends on October 15.

In The month of October, taxpayers must make the presentation of VAT, withholdings on account of Income and the fractional payment of Companies (of the current year), and income (in the case of entrepreneurs and professionals in direct and objective estimation).

In particular, the next October 21 must be presented, and if necessary proceed to the entry, the third quarter of 2019 corresponding to the VAT and al instalment payment of the Personal income tax, in relation to business and professional activities; as well as the income from withholdings on the rentals of business premises and on capital income.

In the case of companies,also on October 21, the deadline to submit the second instalment payment of 2019 of corporation tax ends.

Those Companies that have the status of large company (those whose volume of operations is greater than 6,010,121.04 euros during the 12 months prior to the beginning of the tax period on account of which the instalment payments are made), must present the mandatory form 202,regardless of whether they do not have to make any income in instalments.

This form 202 must be submitted electronically (even if it was therefore “zero fee”), always observing the maximum deadline for submission, which ends on October 21 (unless the payment is domicilie, in which case the deadline for submission ends on October 15).

For this reason, and to be able to make the preparation and presentation of these declarations, it is advisable that all the necessary documentation for these procedures be provided to your trusted advisor in AYCE Laborytax.

If you have any questions or need any clarification on these types of issues, you can

contact

our advisors to help you resolve them.