Although the IAE of the activities carried out by the sole natural person partner and the newly created entity are different, for the application of the reduced rate it is necessary that under the activities of the entity the same as that developed by the partner is not carried out.

Tax rate applicable to newly created entities

Take the case of a natural person constituting a limited company, of which he owns the 100% of its capital,dedicated to the provision of business consulting and courier services, which is registered under heading 849.9 “other services” of Section 1 of the IAE rates. As it had previously carried out an activity under heading 722 “administrative managers” of Section 2 of the IAE rates, it has doubts as to whether the company can apply the reduced tax rate of 15% provided for newly created companies.

In this sense, for the application of the aforementioned reduced rate, it is required that the entity develop a economic activity,that is, that orders on its own account the means of production and human resources or one of both for the purpose of intervening in the production or distribution of goods or services.

By way of exception,a new economic activity is not considered to have commenced when:

- has been carried out in advance by other related persons or entities and has been transmitted, by any legal title, to the newly created entity;

- has been exercised, during the year preceding the formation of the entity, by a natural person holding a direct or indirect participation in the capital or own funds of the newly created entity of more than 50%.

In this specific case, given that the natural person carried out the economic activity of administrative manager, and the newly created company will provide business consulting and courier services; if under these activities the administrative manager is not carried out, the natural person and the newly created entity do not carry out the same activity, and therefore the reduced tax rate of 15% would be applicable in the first tax period and in the next in which the tax base is positive.

Newly created entities

There is a special tax for start-ups, which are subject to the reduced tax rate of 15%, with the particularity that this reduced tax rate is limited in time.

The conditions required for the application of this reduced tax rate are as follows:

- (a) Economic activity:the entity must order on its own account the means of production and human resources or one of them for the purpose of intervening in the production or distribution of goods or services; the economic activity must have started materially (DGT CV 11-7-18). In the event that the activity was the leasing of real estate, it is additionally necessary that for its management, at least one person employed with an employment contract and full-time is used. The newly created entity can apply the reduced tax rate even if part of the positive tax base generated comes from income that does not affect any economic activity, provided that there is a source of income from economic activities and the entity is not considered an asset entity.

- b) Tax rate:the reduced rate is applicable in any case, except that, as provided for in the general regulation of the tax rate of the LIS, the entity must be taxed at a lower tax rate, in which case that other lower tax rate would be applied.

- (c) Temporal scope:the application of the reduced rate of taxation is limited in time, in particular, it is applicable in the first tax period in which the tax base is positive as well as in the following tax period. If in the tax period immediately following the first one in which it has a positive tax base, the entity had a negative tax base, the reduced tax base would not be applicable, and the entity in subsequent tax periods is subject to the corresponding tax rate in accordance with its general or specific tax regime.

- (d) Corporate group:a newly created entity is not considered to be a commercial group, regardless of residence and the obligation to draw up consolidated annual accounts.

Reduced rate and negative bases

If your company is newly created, in the first year in which it obtains a positive base and in the next you can pay a reduced rate.

Below, we tell you how to get the maximum savings if the first few years incur losses…

Reduced rate

Requirements: If your company has been recently established and meets the requirements to enjoy in the Corporation Tax the reduced rate of 15% applicable to newly created companies. These requirements include:

- That the activity has not been previously developed by related persons or entities that have transferred their business to you.

- The activity has also not been carried out during the year prior to the constitution by a partner with majority participation.

- Finally, the company must not be part of a commercial group.

Two exercises: In these cases, the company may apply the rate of 15% during the first year in which it obtains positive bases and the next. As it will be usual that in the first years losses are incurred and negative bases are generated, you must know how to act to obtain the maximum tax savings.

Optimal compensation

Early life: If your company was incorporated in 2015, and in that year and in 2016 incurred negative tax bases (BIN) of 80,000 and 100,000 euros, respectively. Well, if in 2017 you have obtained a positive basis, check if it is convenient for you to compensate for these BIN At that time, or if it is better to wait to do so in the future. But remember that you can exercise compensation in any exercise, with no time limit.

Maximum base at 15%: In these cases, the ideal is that in the first and second year in which the tax base is taxed at 15% is as high as possible, leaving for the following years (in which the rate of 25% is already applied) the compensation of bins. To do this:

- If the first year with a positive basis is high and exceeds the bins pending compensation, postpone the compensation until the third year, when it taxes 25%.

- On the other hand, if the first year with a positive base is lower than bins, in general you will be interested in compensating for it in its entirety, and doing the same in the following years until in one year the positive base exceeds bins. note. In that year no longer compensate BIN and wait until the third year to do so.

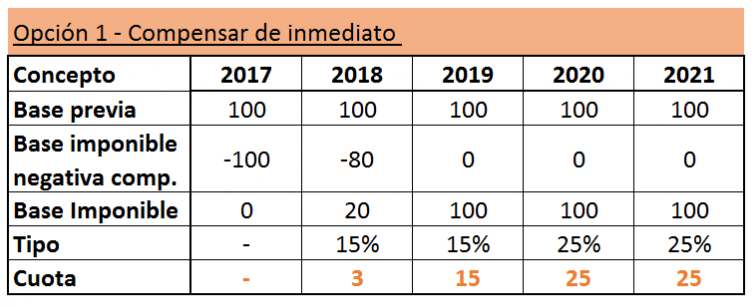

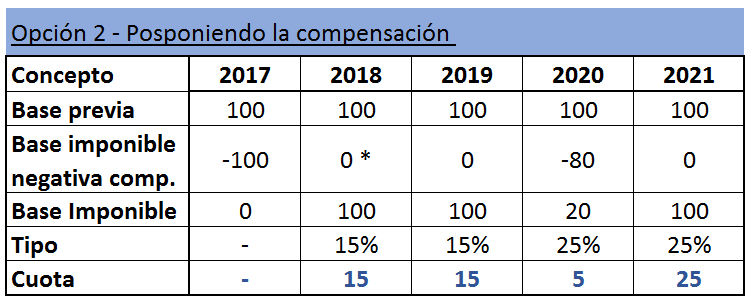

LET’S TAKE AN EXAMPLE:

Continuing with the previous example, if between 2017 and 2021 you get an annual positive base of 100,000 euros, postponing the compensation will allow you to save 8,000 euros. Let’s look at the options:

* As in 2018 the base will be positive even if the pending BIN are compensated, the optimal thing is to wait to compensate them until two years elapse and the company taxes 25%.

It ensures that during the years in which the applicable rate is 15%, the tax base is as high as possible, postponing the compensation until years in which 25% is already applicable.

If you have any questions about how to act in the face of these types of reductions, you can contact us and our team of advisors will be in charge of helping you.