The BOE on 1 June has published the Royal Decree-Law 20/2020,of 29 May, by which minimum living income is established,which is set up as a new economic benefit in its non-contributory form of Social Security,which may apply for all people who have between 23 and 65years of age, or from the age of 18 if the applicant has minors in charge, who have at least one year of legal residence in Spain.

Access to aid will depend on the income level and the estate of the person requesting it. In addition to income, the applicant’s net worth will be checked, subtracting their debts, and without regard to the usual housing. The wealth limit increases depending on the number of people in the cohabitation unit. It is 16,614 euros for a person who lives alone and will increase for each additional member up to a maximum of 43,196 euros.

It can be requested from June 15 and all applications made from that day until September 15 will be charged retroactively to June 1.

You are interested in:

BOE: Royal Decree-Law 20/2020 establishing Minimum Living Income

In the BOE on 1 June, Royal Decree-Law 20/2020 of 29 May establishing the minimum living income, through a non-contributory social security benefit, and with effect from 1 June 2020, has been published.

The purpose of the standard is to create and regulate the Minimum Vital Income (IMV) as preduction aimed at preventing the risk of poverty and social exclusion of people living alone or integrated into a cohabitation unit, when they are in a vulnerable situation because they lack sufficient economic resources to meet their basic needs.

Minimum Living Income is defined as the subjective right to a benefit of an economic nature that guarantees a minimum level of income to those in situations of economic vulnerability in the terms defined in this RDL 20/2020. This instrument aims to ensure an improvement in real opportunities for social and labour inclusion of beneficiaries.

In the development of article 41 of the Spanish Constitution, and without prejudice to the aid that can be established by the autonomous communities in the exercise of their powers, the minimum living income is part of the protective action of the Social Security system as an economic benefit in its non-contributory form.

What is Vital MinimumIncome (IMV)?

It is a non-contributory benefit of a subjective and non-transferable nature for those households in severe poverty,currently aggravated by the coronavirus pandemic.

Your payment will be monthly, fully 12 pays per year, and will be received as long as there are the reasons that led to your concession.

Beneficiaries of this benefit

There will be a right holder, but it will go to the“unity of coexistence“, a new concept set out in this RDL to refer to household members, made up of people who live together, united by family ties or as a de facto partner, up to the second degree of inanguinity or affinity, or adoption, is kept for adoption or permanent family acceptance purposes. Living together means that some expenses are shared and that’s why the amount to be charged is adapted.

A family is considered vulnerable where your monthly income is lower, in the terms set out in Article 18, at least EUR 10, to the monthly amount of the income guaranteed with this benefit which corresponds according to the modality and number of members of the cohabitation unit under the terms of Article 10.

Requirements of the holders of the “unity of coexistence”:

- Be between 23 and 65 years old and have been constituted as a home for at least three years. The limit has been set at 65 years because non-contributory pensions are already collected at this age (at least EUR 462 per month).

- Be 18 years of age if the applicant has minors in charge, constituted as a household for at least one year.

- If beneficiaries live alone, they must be emancipated at least three years earlier.

In cases where the holder of this benefit is unemployment, he shall be required to be registered as an employmentseeker.

In the same address there may be a maximum of two holders.

For all types of household, at least one uninterrupted year of legal and effective residence will be required in Spain, except in situations of gender-based violence, trafficking and sexual exploitation.

Women who have left their usual family home accompanied by their children and relatives until second grade by insanguinity or affinity may also have access to the minimum income.

These special groups shall prove this condition through a report issued by the services that serve them or by the public social services. In addition, the Implementing Regulations of the Law shall provide for exceptions to the requirement of registration as an employment claimant.

Users of a residential, social, health or socio-health service benefit from the provision of minimum living income, on a permanent basis and financed by public funds, except in the case of women victims of gender-based violence or victims of trafficking in human beings and sexual exploitation, as well as other exceptions established by regulation.

Rents to consider

The rules for the calculation of rents that are accounted for are set out in Article 18.

Minimum living income is designed to complete pre-existing income (including wage income) up to the guaranteed threshold for each type of household. If no rent is available, the entire guaranteed threshold would be secured; but if available, the difference between the guaranteed threshold and the existing income would be covered.

Reference is made to the previous year’s Tax Returns; however, due to the economic consequences caused by covid-19, the transitional provision 3a allows access to this group taking into account the proportional income corresponding to the period of time elapsed this year.

The level of income and the level of real estate assets shall be measured, not counting the usual and financial housing set out in Article 18.5

Wealth limits in 2019 to access aid by 2020

These thresholds are linked to those of the minimum living income and start from the basis of three times the contributory pension (16,614) with multipliers as the units of coexistence are greater.

|

Cohabitation units |

Wealth limits |

|---|---|

| An adult | €16,614.00 |

| An adult and a child | €23,259.60 |

| One adult and two children | €29,905.20 |

| An adult and three or more children | €36,550.80 |

| Two adults | €23,259.60 |

| Two adults and one child | €29,905.20 |

| Two adults and two children | €36,550.80 |

| Two adults and three or more children | €43,196.40 |

| Three adults | €29,905.20 |

| Three adults and one child | €36,550.80 |

| Three adults and two children | €43,196.40 |

| Four adults | €36,550.80 |

| Four adults and one child | €43,196.40 |

| Other families |

€43,196.40 |

We see that the wealth limit increases depending on the number of people in the cohabitation unit. It is 16,614 euros for a person living alone, and will increase for each additional member up to a maximum of 43,196 euros.

This benefit is compatible with social aids such as scholarships or study aids, housing aid, emergency aid and the like, as well as with autonomic social income. And with regard to the rental of the house, the regulations of the Law will contemplate possible increases in the amount to be received as Minimum Vital Income when the costs of renting the usual home are credited.

Amount of benefit

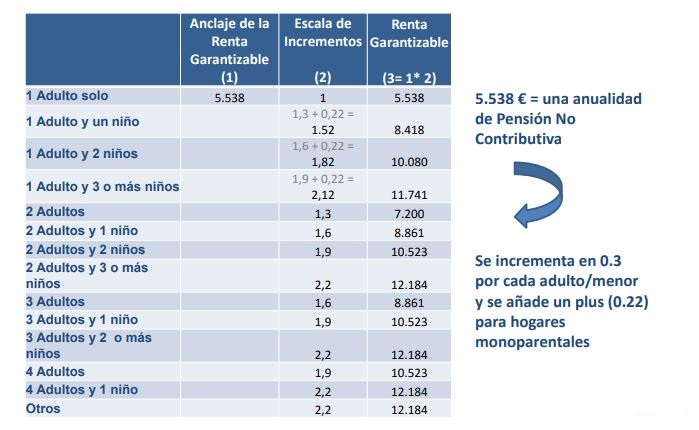

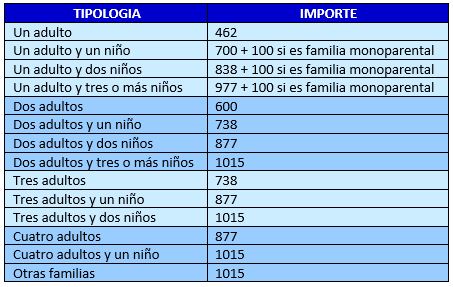

Minimum living income is based on a wide range of households (depending on the number of members and whether they are single-parent) and establishes a different level of guaranteeable income for each type of household. The minimum level, which corresponds to single-person households, is EUR 5,538 per year, the equivalent of a non-contributory pension. From this amount, an additional coefficient is established for each household member (0.3 for each adult/minor) and a benefit for single-parent households (plus 0.22), according to the following table:

This is not a fixed amount,but a supplement until it reaches the minimum established.

14 types of households are established with different income thresholds, with special attention to single-parent families.

As we see, the minimum for a single-person household is 461 euros for 12 pay, which is the equivalent of non-contributory Social Security benefit (395.60 euros for 14 pay). From this amount, a number of multiplier coefficients are applied, depending on the type of family and the number of children, with special attention to single-parent families (80% are women).

The amount of the benefit shall be amended if the personal, economic or economic circumstances of the person benefiting from the minimum living income, or of one of the members of the cohabitation unit, change.

Application for the benefit

During the month of June, Social Security will grant “ex officio” this benefit to households already listed in extreme poverty: an estimated 100,000, especially people receiving child benefit in charge.

A multi-channel system will work with regional and local agencies, such as town halls, who can better identify homes needed to reach more homes.

From June 15th it can be requested through the Social Security portal. The application can also be sent by regular mail. Social Security has three months to respond, and if the request is not answered within this period, the request is understood to have been denied.

In addition, to provide information to potential beneficiaries, a 900 phone and simulator will be launched on the Social Security website, where doubts can also be consulted through the virtual assistant.

Agreements will be signed with autonomous communities and local entities so that they can assist interested persons in making the application.

The following documents will need to be submitted (art. 19):

- ID, family book, or birth certificate.

- To prove legal residence in Spain: registration in the central register of foreigners, family card of citizen of the European Union or residence permit.

- To prove the address in Spain: certificate of registereding.

- To prove the existence of the cohabitation unit: registration certificate or family book, civil registry certificate, or registration in the registration of de facto couples.

It will not be necessary to prove the income and the heritage: it will be carried out automatically by the National Institute of Social Security with the information of the Public Treasury. Nor will it be necessary to have filed the income statement.

Date of collection of the benefit

At the end of June, families to which this benefit is recognized will be accessed ex officio.

All applications made from June 15 to September 15 will be charged retroactively to June 1.

Basic CCAA insertion income

The national minimum income shall be the minimum; the minimum income benefits of the autonomous communities that already have it will be complementary and subsidiary to the national. This will mean that autonomy must redefine its benefits on the part of the guaranteed state minimum, deciding where they complement or whether they focus on a collective that is not covered by the IMV, either by adapting it to the different price levels that exist in one territory and another, or to complement, for example, housing or other circumstances that the CCAAs consider.

The management of this minimum living income will be done by the central government, with the exception of the Basque Country and Navarra: by its foral regime, it will be themselves that manage this benefit. Catalonia and the Valencian Community have also requested its management.

You are interested in:

Programs in force in the various Autonomous Communities

Possibility to work during the collection of this benefit

Work may be made provided that these new incomes, both labour and those earned by self-employed persons, do not exceed the income threshold established at least for the household concerned.

In the event that the holder finds work, part of his salary will be temporarily exempt in the calculation of the benefit. And if the holder already works and his salary increases, the amount of the benefit will be reduced by a lower amount.

*Not included in this RDL, but clarifies that it will be developed in a later regulation.

Employment Itineraries and Social Seal

As already indicated, one of the objectives of this minimum living income is to be a transitional situation towards an active job search. Therefore, in order to benefit from this benefit, the obligation to comply with work or inclusion itineraries is established, which will be defined on the basis of agreements with autonomy and municipalities.

The Social Seal is also created: an accreditation for private companies that help vulnerable groups with discounts on purchases through the digital social card, that allow their integration into the labour market or that incorporate in their templates people who benefit from this benefit. There will even be Social Security incentives for the recruitment of beneficiaries. The RDL refers the regulation of this Social Seal to its regulatory development.

Digital Social Card

The Digital Social Card is created with the aim of improving and coordinating social protection policies promoted by the different public administrations.

Other benefits of collecting Minimum Living Income

The beneficiary of the Minimum Vital Income is entitled to exemption from university fees for the study of official degrees at least during the 2020/2021 academic year.

And also to the exemption from the contribution of users to the outpatient pharmaceutical benefit.

Suspension of the right

Article 14 contains the reasons why the collection of the minimum living income, which are:

- Temporary loss of some of the established requirements.

- Temporary non-compliance or indications thereto by the right holder or any of the members of the cohabitation unit of the obligations assumed when accessing the service, obligations set out in Article 33.

- Transfer abroad for a period, continuous or not, greater than 90 calendar days per year, without having informed the managing entity in advance of it or being duly justified.

If the causes of the suspension persist for one year, the right to benefit will be extinguished.

Extinction of the right

This benefit shall no longer be received by:

- Death of the right holder. If another member of the cohabitation unit is eligible to be a holder, a new application may be filed within three months of death.

- Definitive loss of any of the requirements.

- Resolution of a sanctioning procedure.

- Departure from the national territory without communication (art. 14.2).

- Repeated non-compliance with the conditions associated with the compatibility of minimum living income with income from work or economic activity on its own account (art. 8.4).

Transitional economic benefit of minimum living income during 2020

The transitional provision 1 of DRL 20/2020 determines the transitional provision of the minimum living income during 2020, for beneficiaries of the financial allowance per child or minor in charge, without disability or with a disability of less than 33%, who meet certain requirements and whose economic allocation is less than the amount of the minimum living income benefit. This transitional benefit shall be incompatible with the collection of the financial allowance per child or minor paid, without a disability or with a disability of less than 33%: the minimum living income may not be charged if the same cause or beneficiary exists. However, it is possible to choose one of them.

Transitional provision 7a regulates the integration of child or child benefit into the provision of minimum living income. As of 1 June 2020, no new applications may be submitted for the financial allowance per child or minor in charge of no disability or with a disability of less than 33%, without prejudice to beneficiaries who as of 31 December 2020 do not qualify for minimum living income, who may exercise the right of choice to return to the economic allowance per child or lesser under the Social Security system.

As from 31 December 2020, beneficiaries who maintain the requirements that gave rise to the recognition of the transitional benefit will become beneficiaries of the minimum living income.

Repayment of unduly received benefits

The INSS may review of its own motion the benefits being received and declare or demand the repayment of what has been improperly received in cases where the reasons for which it was granted have been extinguished, or where the amount to be received is less than the amount received.

Violations and sanctions

Article 34 sets out which violations may apply to responsible subjects: minor infringements, such as not handing over the required documentation; serious violations, if you do not report possible changes in the situation of the home; or very serious infringements, such as fraudulent action in order to obtain undue or higher benefits than they correspond.

The penalty ranges from a simple confirmation in the first case to the loss of aid and the payment of an amount equivalent to six months.

Advisory Council Monitoring Committee

Article 30 sets out the establishment of the Commission for monitoring the application of minimum living income and its corresponding functions, which shall be chaired by the Minister of Inclusion, Social Security and Migration, and shall be supported by the Secretary of State for Social Security, to whom a Minimum Life Income Advisory Council will be added, as a cooperation body with the entities of the Third Sector of Social Action.

The Advisory Council is also established, as a consultative and participation body with entities in the Third Sector of Social Action and trade union and business organizations

The result of minimum living income and the various inclusion strategies and policies will be assessed annually by the Independent Fiscal Responsibility Authority (AIReF), by issuing the corresponding opinion.

Inclusion in the Register of Public Social Benefits

In accordance with additional provision 2a, minimum living income benefits are included in the Register of Public Social Benefits.

Amendment of the General Law on Social Security (LGSS)

The final provision 4a modifies different articles of the LGSS to adapt this new benefit to the General Social Security System. Among these amendments, we highlight that of Article 42.1.c LGSS, to include the provision of minimum income within the protective action of the Social Security system and thus incorporate the necessary data facilitation obligations for the recognition, management and supervision of the benefit by the Ministry of Finance, autonomous communities, provincial councils, Ministry of the Interior , mutual partners with Social Security, Institute of Majors and Social Services and competent regional bodies.

Arts are also redrafted. LGSS 351, 352 and 353, which list non-contributory family benefits, the economic allowance of children or minors in charge and their amounts.

Future Implementing Regulation

The final provision 10a opens up the possibility of drafting a regulation setting the conditions for individual situations of income falls in one year, and so that the person concerned does not have to wait all year round.

You are interested in:

conclusion

In short, a company can carry out employee layoffs after an ERTE. Six months after return to work, any company may fire any worker, and those who are at risk of entering creditor competition may make redundancies without waiting.