Since last July 18, 2019, a new Order was published that regulates the keeping of the Record Books in personal income tax, with effects for the annotations corresponding to the 2020 fiscal year and following.

Books Registration in personal income tax

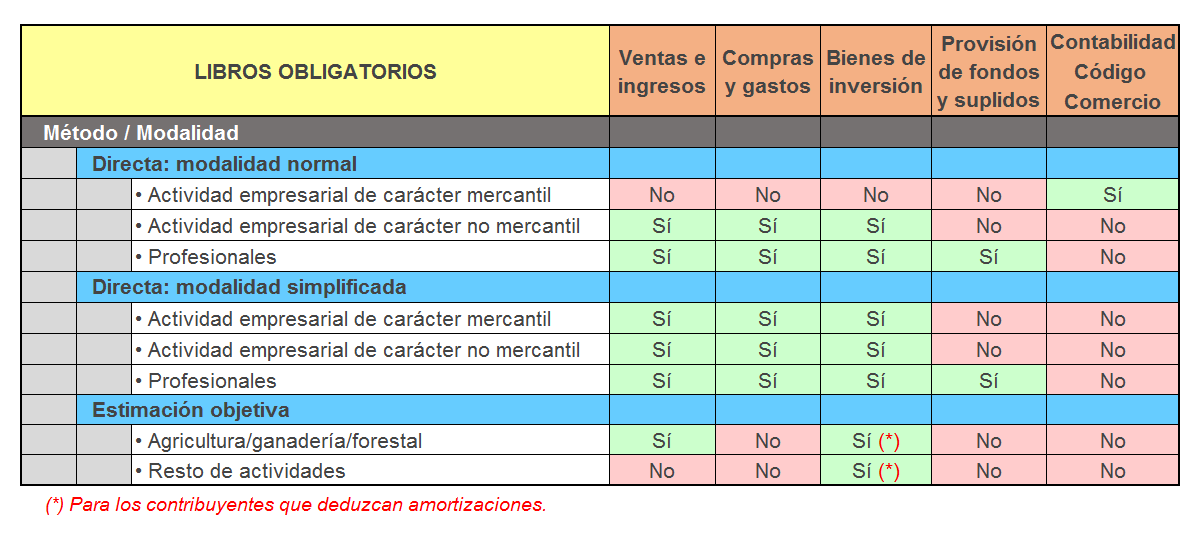

Personal income tax taxpayers who carry out business activities whose performance is determined in the simplified method of direct estimation, as well as those who carry out a business activity in direct estimation that not of a commercial nature in accordance with the Commercial Code, they are obliged to keep the record book of sales and income, record book of purchases and expenses and the record book of capital goods.

Likewise, taxpayers who carry out professional activities whose performance is determined in a method of direct estimation,in any of its modalities, are obliged to keep an income book, an expense book, a record book of investment assets and a record book of provisions of funds and supplies.

Taxpayers who carry out business activities whose performance is determined by the objective estimationmethod, in the event that they deduct depreciation, are obliged to keep a record book of investment assets. In addition, for activities whose net return is determined taking into account the volume of operations, they have to keep a record book of sales or income.

And finally, the entities in the regime of allocation of income that develop economic activities, keep a single mandatory books corresponding to the activity carried out, without prejudice to the attribution of income that corresponds to make in relation to their partners, heirs, commoners or participants.

Given that the precepts that develop this matter correspond to an Order of 1993, and taking into account the modifications made in the Personal Income Tax since that year, it is necessary to update and revise its content. Consequently, Order 4 May 1993 is repealed and this Order is approved with the following novelties:

- the requirements and characteristics that must be included in the record books of each of the modalities are detailed in the articles;

- in the books records of sales and income and of purchases and expenses, the NIF of the counterparty must be included in each operation;

- it establishes the possibility that the personal income tax record books are compatible with those required in the VAT, and can be used for the latter as long as they conform to what is required in the RIVA; and

- it also specifies a series of notes common to the record books, such as the formal requirements, the deadline for the annotations, how and when to proceed with the rectifications and the obligation to preserve and make available to the Administration the documents that accredit the registered operations.

The entry into force occurs on July 18, 2019, being applicable for the registry entries corresponding to the 2020 financial year and following.

Finally, as foreseen in the Explanatory Memorandum, the Tax Agency will publish on its website a standard format for books, in order to offer legal certainty and certainty in their minimum content.

Keeping of Books Records in personal income tax

The Regulation of income tax on individuals establishes the following accounting and registration obligations for personal income tax taxpayers:

notes:

1) Entities under the income allocation regime that carry out economic activities must keep only mandatory books, in accordance with the commercial nature or not of their activity, and without prejudice to the allocation of income they make.

2) Please note that as of 1-1-2019, the exemption from the obligation to keep record books has been abolished for taxpayers who keep accounts in accordance with the provisions of the Commercial Code (RIRPF art.68.10 redacc). RD 1461/2018).

If you have any questions or need any clarification about The Record Books, you can contact

any of our advisors so that we can help you resolve them.